The U.S. Treasury sold a record $42 billion of 10-year notes on Wednesday and, much to relief of bond bulls, the auction saw strong demand with a bid-to-cover higher than the average over the past six auctions. The auction also stopped through, which means that the highest yield resulting from the auction was lower than the “when-issued” yield, bucking the trend of the last four auctions where demand was less robust. The strong 10-year auction on Wednesday was followed up with a 30-year auction on Thursday, where the Treasury sold $25 billion of 30-year notes, just $2 billion below the record during the peak of the COVID pandemic. The 30-year auction also had a bid-to-cover that was higher than its average over the last six auctions and had the biggest stop through (positive indicator) since January of 2023. The stellar auction was punctuated with robust foreign demand, leaving dealer bidders to take down much less than the recent auction average.

The bottom line is that the auction results this week were very positive, showcasing that investors are getting comfortable adding duration to their portfolios. While this may seem to be at odds with recent guidance from Powell and other FOMC members who have pushed back on the probability of an interest rate cut in March, my sense is that market participants are paring their expectations around the soft-landing narrative that has been permeating through financial markets. One of the prevailing trades in bond markets recently has been to ‘bet’ on the yield curve to steepen as an economic soft-landing comes to fruition. To express this view, traders will go ‘long’ short-term notes (e.g., three-month bills), while subsequently shorting longer-term notes (e.g., 10-year). One of the benefits to this trade is there is a positive carry and traders get paid to hold this position while waiting for the yield curve to steepen. By going long three-month bills, a trader will ‘receive’ a 5.4% yield, while only having to ‘pay’ a yield of 4.2%, so there is a positive spread to hold this trade while betting short-term rates will go down at a faster pace than long-term rates.

Given that in a normal market environment long-term yields should be higher than short-term yields to reflect a risk premium, it makes sense that in a soft-landing scenario we should see a steepening of the yield curve as the Fed cuts short-term rates and long-term rates remain near current levels. However, the challenge with positive-carry, convergent trades, is that a shock to the system can create short-term pain that may make it hard to hold the position to completion, which could materialize should long-term yields fall while short-term rates stay steady.

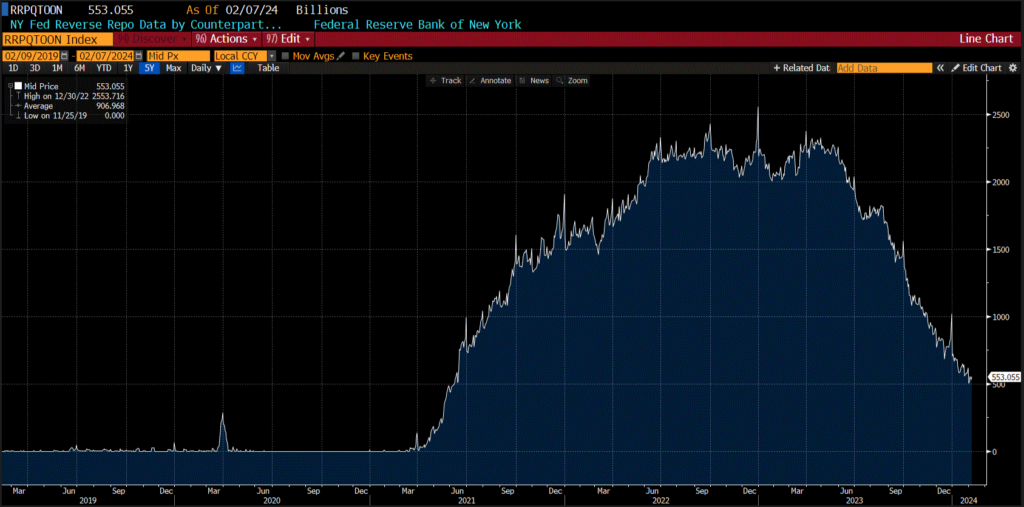

In a bit of cognitive dissonance, the stronger the incoming economic data, the more likely higher rates persist, increasing the probability the Fed only begins cutting short-term rates when something in the economy breaks. In conjunction with a recent bout of stronger-than-anticipated economic data, interbank liquidity is becoming more of a concern, with assets accessing the Fed’s reverse repurchase facility declining almost in lockstep with a reduction in the Fed’s balance sheet. A deputy manager of the New York Fed’s open market operations made headlines on Wednesday saying that she doesn’t think the central bank’s balance sheet will be able to return to its pre-COVID levels as higher levels of reserves will be needed to support the long-term growth of the economy. Given that Powell and other FOMC members have poured cold water on a rate cut at their next meeting in March, market attention will be directed towards the Fed’s quantitative tightening program and whether they will be able to continue at the same pace without putting too much pressure on short-term money markets, as further balance sheet runoff will continue to sap liquidity from the system (Figure 2).

Although there has been a slight steepening of the yield curve to begin 2024, I’m inclined to follow this week’s bond auctions for overall investor sentiment and believe the balance of risks is tilted towards the Fed waiting too long to pre-emptively lower rates before there are more material stresses in the system. While the direction of short-term rates from current levels is undoubtedly lower, timing uncertainty leads me to favour duration exposure as a hedge on bigger fissures emerging.

Happy investing,

Scott Smith, Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.