When it comes to your ETF and mutual fund investments, how much attention do you pay to the Manufacturer Report on Fund Performance (MRFP)?

- Do you actively seek it out—either by searching online or asking your financial advisor?

- Do you actually read the entire document? (Glancing at graphics or tables doesn’t count!)

- Do you fully understand the purpose and contents of this document, even when switching between different issuers?

- Do you use it to make informed investment decisions or to ask more pointed questions?

If your answers are mostly “no,” you’re not alone—and regulators are taking steps to address this issue.

Let’s dive into the academic side of things for a moment.

In a study published by the Journal of Economic Behavior & Organization, researchers explored how market returns affect investor behavior when it comes to checking investments. Scholars like Karlsson, Loewenstein, and Seppi found that investor attention depends largely on market performance. They described two types of investors:

- The “ostrich,” who avoids information, particularly bad news (i.e., negative investment returns).

- The “meerkat,” who seeks out information, especially when positive returns are involved, to validate their investment decisions.

Fast-forward to today, and these psychological insights are being applied by market regulators. The Canadian Securities Administrators (CSA) are currently in phase four of a six-phase process aimed at improving fund report design. Using behavioural economic principles, their goal is to create a continuous disclosure document that investors will actually read—whether they’re an ostrich or a meerkat.

What Are the Barriers?

Several obstacles prevent investors from engaging with MRFPs:

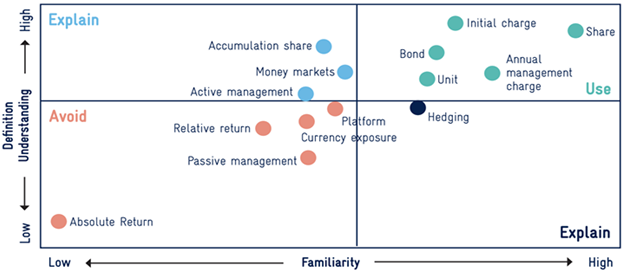

- Jargon: The financial industry uses terminology that can be confusing, even for seasoned investors. The CSA created a table (Figure 1) to visualize the terminology that investors struggle with and perhaps guide issuers with better language choices.

- Information Overload: These reports can stretch up to 10 pages, making them a daunting read for most.

- Poor Presentation of Information: Excessive text (a.k.a ‘text wall’) dissuades readers.

- Outdated Information: Since MRFPs are only required twice a year (on December 31 and June 30), they can feel irrelevant if you’re looking to invest, say, in November.

Streamlining the Process

The CSA has acknowledged that investors don’t typically read long documents. Their research suggests that three to four pages is the sweet spot. Also, the most important information needs to be front and center due to the primacy effect (i.e., people tend to remember the first information they see). More visuals, like charts and infographics, are needed to break up the dreaded “text wall.”

Initial trials of revised MRFPs have shown some improvement, but we’re not there yet. Investor comprehension of the new documents still resulted in only a 46% pass rate.

Key Problems We Need to Solve

- Total Expense Disclosure: Investors avoid calculating total expenses (MER + TER), as it requires mental math. Expect new regulatory requirements to clarify this with a “Total Fund Expense Ratio” provided by the issuer.

- Fund Performance Contributors: Terms like “overweight” and “underweight” are too vague. Investors need clear explanations about what drove performance—whether positive or negative. Greater transparency is expected, so look for details on which securities contributed the most to returns, which ones didn’t perform, and why.

- Series Performance Differences: Different series of the same fund can show differing rates of return, and while you could figure this out manually, it’s not reasonable to expect investors to do so. This is one area where increased clarity and simplification would be welcome. Some funds have up to 10 series. As Kimberly Wilkins famously said, “Ain’t nobody got time for that!“

What’s Next?

The CSA will soon be gathering feedback from both the industry and the public on the revised fund reports, with the aim of finding solutions to these lingering issues.

As with anything, change is constant—and in this case, it’s for the better.

Compliance. Reading the fine print, empowering ethical investment management.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.