In 1994, James Carville, a political adviser to President Clinton, remarked, “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

Almost thirty years later and James Carville’s words are still ringing true. The recent surge in bond yields is starting to intimidate even the Federal Reserve, with Jerome Powell indicating that higher long-term yields “can have implications for the path of monetary policy,” and a continued rise in long-term yields will do a lot of heavy lifting for the Fed when it comes to tightening financial conditions. Although the Fed will likely hold short-term interest rates steady at their next policy meeting in early November, bond markets are continuing to price in a “higher for longer” monetary policy environment. The implications of a longer than anticipated timeline before the Fed takes their foot off the proverbial break is reverberating through bond markets, continuing to push bond prices lower.

It doesn’t appear that the bond market will get any less intimidating in the short term. Even though higher interest rates are wreaking havoc on the bond market, the U.S. economy expanded by an annualized rate of 4.9% in the third quarter, the fastest in almost two years. This article from the Wall Street Journal explores the robustness of the U.S. economy through the resilience of consumer spending, and how an aging population is contributing to a hot economy. The 70 and older cohort in the U.S. holds nearly 26% of household wealth, which is the highest level in over three decades. This cohort has less consumer debt, minimal student debt, and is more likely to own homes outright. This confluence of factors is helping to buffer against the effects of higher interest rates and is likely, at least partially, responsible for the robustness in consumer spending. The article outlines that consumer spending by Americans 65 and older accounted for 22% of total consumer spending in 2022, which is the highest level since 1972. In addition to the resilient U.S. consumer, the job market is still extremely tight, with hourly earnings remaining elevated and job vacancies beginning to rise again. Inflation is indeed cooling, but core measures remain sticky and market expectations of future inflation are back to levels from early 2022.

While the strong economy and sticky inflation are valid reasons for a continued rise in bond yields, some experts are pointing towards other factors driving yields higher, reflecting an increased risk of holding longer-duration bonds (as opposed to rolling short-term paper) known as “term premium.” An increase in the supply of treasuries due to larger than anticipated government borrowing has led to some skepticism about the future path of fiscal spending, along with the fact that many large buyers of treasuries have been stepping away from the market. Although the Fed may be close to done raising short-term rates, they continue to reduce the size of their balance sheet through quantitative tightening, removing the Fed as a major participant as a warehouser of government debt. At the same time, large foreign buyers of treasuries have less U.S. dollars to recycle into the treasury market, as the share of U.S. dollars in global foreign exchange reserves have been declining at a modest pace. Less price insensitive participants in the treasury market may have titled the supply and demand dynamics to where market participants are now demanding more yield premium to hold longer-date debt.

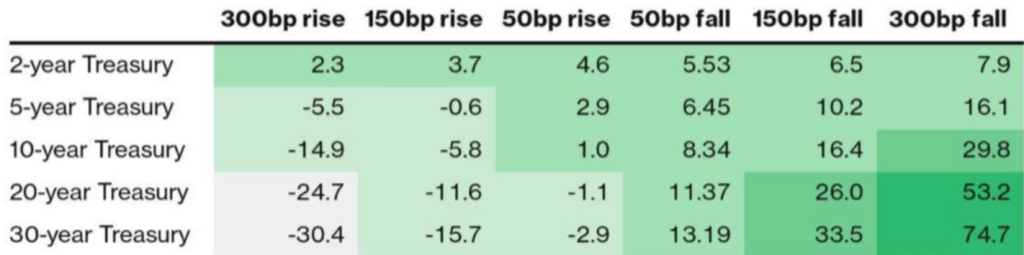

Though the outlook for the bond market appears bleak, there are some signs of green shoots. A result of the rise in interest rates is that as new debt gets issued at market rates, the larger coupon payment reduces the duration of similar maturity debt and adds convexity to the position. This increased convexity makes it such that there is now an asymmetric risk profile for treasuries, where a fall in interest rates generates a larger total return than an equal rise in interest rates. (Figure 1) This doesn’t mean that interest rates can’t continue to move higher, but it does mean that the risk profile of new issue bonds is now more attractive. The last large auction for 20-year notes was well received with a high bid-to-cover ratio and good demand from direct customers, illustrating some of these factors might be trickling their way into investor sentiment. However, even with a more optimistic long-term outlook for bond investors, it is unlikely the bond market will ever stop intimidating people.

Bond Market’s Risk Reward: Estimate 12-Month Total Returns Based on Different Yield Movements

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.