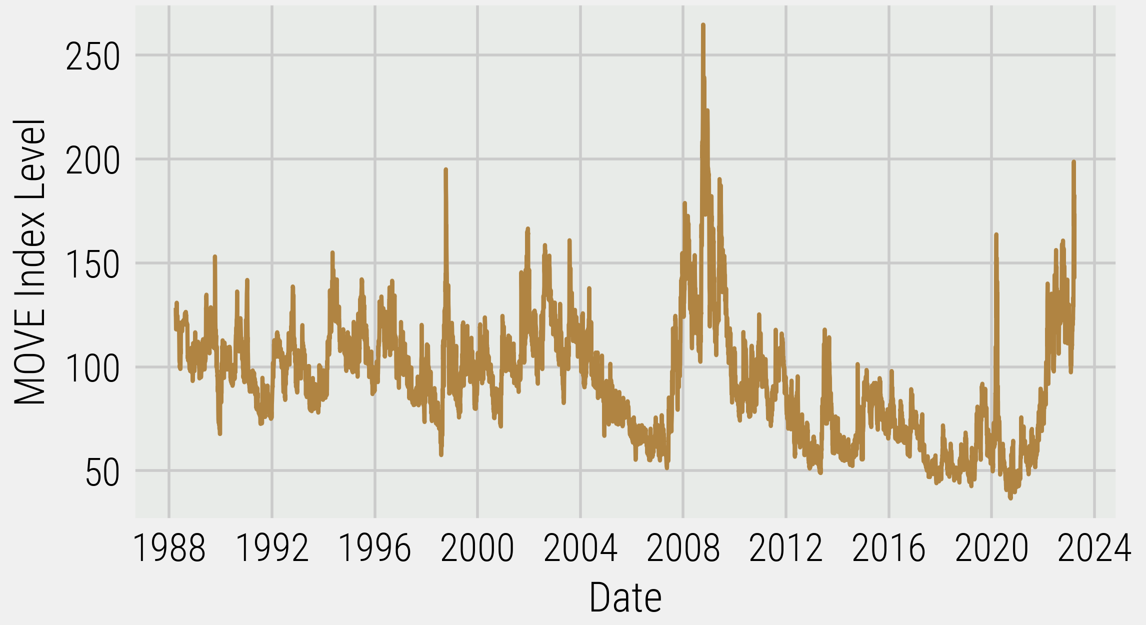

One of the big questions on investors’ minds over the last few weeks is whether the dramatic rise in interest rates is finally starting to take its toll on the economy. The collapse of Silicon Valley Bank (SVB) set off contagion worries in the banking sector and has increased the risk of an economic recession. The surge in banking stresses has also fueled a continued rise in bond market volatility (Figure 1), with traders quickly shifting their interest rate expectations in response to the unfolding events. As of February 28th, market expectations were that the overnight interest rate would peak around 5.4% and stay close to this level for the remainder of this year. With the confluence of events that have recently unfolded, as of March 24th, the market has not only priced out an end to additional rate hikes for 2023 (with the current implied overnight rate at 4.8%) but is expecting the first interest rate cut to arrive by summer. Jerome Powell and the FOMC executed what the macro community would say was a “dovish” rate hike at the last monetary policy meeting, leading many to wonder if the FOMC is beginning to acknowledge that the economy has started to show some cracks from elevated borrowing costs.

Figure 1: Bond Market Volatility (1988 – 2023)

Source: Bloomberg

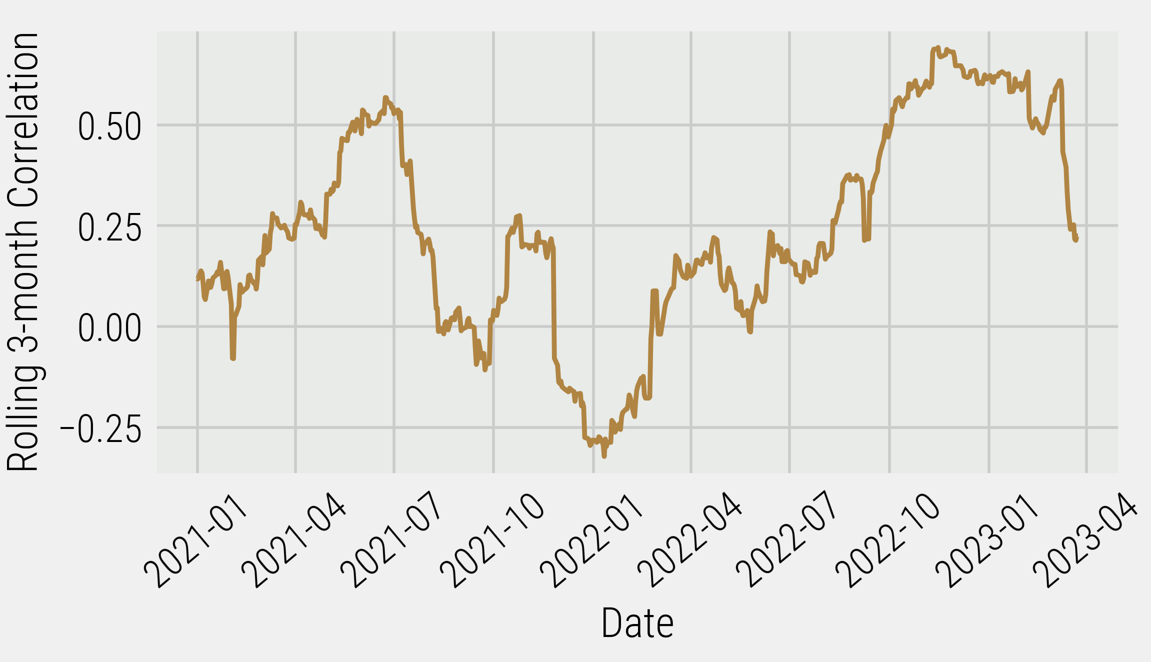

For all of 2022, the consensus trade was to be short bonds as higher interest rates put downward pressure on prices. The combination of falling prices and the inability of bonds to protect a portfolio against declines in equity markets made 2022 a challenging environment for fixed income investors. From an investment perspective, Viewpoint’s multi-factor overlays still favour equities relative to bonds based on risk-adjusted carry; however, the momentum factor has started to swing in favour of bonds, closing the gap relative to equities. Add in the fact that bonds have also been acting as a portfolio ballast to equity market weakness over the last month as investors fret over a potential recession, and bonds may be en vogue again.

While the immediate market reaction to the fallout from SVB was that the Federal Reserve (Fed) has “broken” something in the economy due to the breakneck pace of interest rate increases, the response from the Fed was to put backstops in place to stabilize the banking system and reduce the probability of additional bank runs. Although there was much discussion in the pundit space on whether these backstops were akin to a “pivot” or a “restart of Quantitative Easing,” our take is that shoring up the banking system signals that the Fed remains committed to elevated interest rates until there is a meaningful rebalancing of the labour market, as opposed to an outright pivot. The programs put in place continue to give the Fed the ability to retain flexibility of higher interest rates while reducing the potential for financial contagion. It would appear the Fed is not yet convinced consumer prices are on track to fall back towards their stated target band, and there is additional labour market weakness that will be required in order to achieve this.

This article from the Financial Times analyzed the SVB failure and showed the Achilles heel of the bank wasn’t the lack of hedging the interest rate risk of their “held-to-maturity” bond portfolio. Rather, their concentrated depositor base and the lack of profitability in 2022 led them to unwind hedges on their “available for sale” bond portfolio as a way to generate additional profits to bolster the income statement. It’s hard to allege that the Fed has “broken” something in the market when the unwise risk management practices of SVB and Credit Suisse are the reasons those specific entities wound up on the wrong end of the interest rate sword. This doesn’t mean SVB isn’t the canary in the coal mine, just that the Fed is likely going to need to see additional labour market rebalancing before being assured that consumer prices will fall back towards its target. Therefore, our view has yet to change that investors expecting a sharp U-turn from the Fed may need to realign their expectations. Instead, what investors should be focused on is improvement in diversification across the investment landscape with correlations displaying an increase in opportunities to harness diversification through the application of prudent, liquid leverage on efficient public market portfolios.

Figure 2: Rolling 3-month daily correlation between Global Equities and Global Bonds

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.