Back in February, I wrote an article called FOMC Gymnastics and a Potential Policy Misstep, which explored the likelihood that the FOMC (Federal Open Market Committee) could make a policy misstep that would have negative implications for asset prices. That piece explored five factors which made the current tightening cycle more difficult to interpret:

- An inflationary spike not seen in over 40 years.

- The first tightening cycle ever implemented that would see simultaneous monetary and quantitative tightening.

- Continued COVID-related dislocation in supply chains.

- Many believed the Fed was “behind the curve.”

- Russian President Vladimir Putin’s brinkmanship over the Ukraine (the invasion happened later in the week).

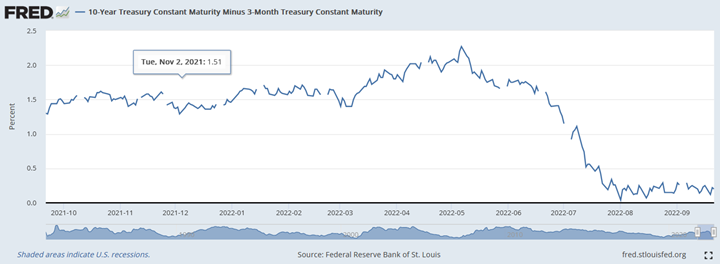

We concluded that there was a good chance that the Fed would make – or had already made – a policy misstep that would have negative implications for asset prices. With seven months of hindsight, most macroeconomic watchers are now in agreement that the Fed has already made a policy mistake this cycle by remaining accommodative for too long and not raising interest rates sooner. This point has been underscored by the persistently high inflation numbers we have seen over the past six months.However, we now have to focus on the tightening cycle and what we can expect moving forward. With each tightening cycle, the Fed strives to achieve a “soft landing,” which is a Goldilocks outcome where the Fed raises interest rates just enough to stop an economy from overheating without causing a severe economic downturn, thereby avoiding a recession. Since mid-August, many commentators have been claiming that a recession is a foregone conclusion, and it was only a matter of time. However, we have still not seen the yield curve inversion that would signal a recession was imminent. The U.S. 10-year yield minus three-month Treasury bill has bottomed at 0.04% but has yet to invert.

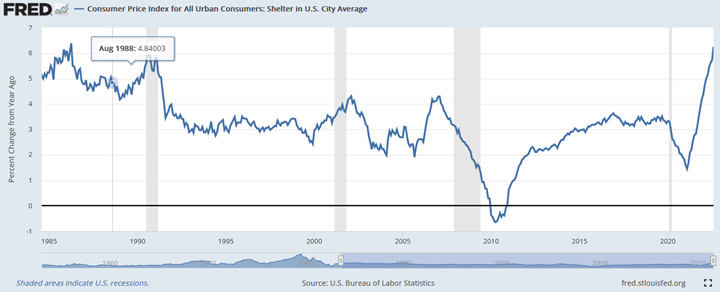

Although a 10-year minus three-month inversion may occur with one of the impending rate hikes, many expected that we would already be in recession by Q4 2022. However, the U.S. economy has proven much more resilient than many expected and if a recession does come, it will likely be later in 2023.Even though the Fed has avoided a second policy error so far, we are not out of the woods yet. As highlighted by Darius Dale of 42Macro, “we all know the year-over-year numbers are high. But when you’re talking about three-month annualized rates of change in the month of August, we’re still building a considerable amount of inflationary pressure in the system.”For instance, Shelter CPI, which makes up 32.77% of CPI, is continuing to surge forward. Also, this measure is a survey-based measure that is 7.8% weighted to rent and 23.68% weighted towards owners equivalent rent, or the amount of rent that would have to be paid in order to substitute a currently owned house as a rental property. The impact of this measure on inflation is known to lag and is expected to continue to impact inflation for many more months.

Dr. Thomas Hoening, the former President of the Federal Reserve Bank of Kansas City, notes that the potential for persistently sticky inflation has set up the Fed for a significant challenge.

“. . . if the unemployment rate starts to rise significantly, and if the economy does slow into a recession, even if inflation is still above 6% or 7%, there’ll be enormous pressure on the Federal Reserve to reverse itself. And that’s when we’ll know whether they’re going to stick to the plan.”

If the FOMC ends up getting rid of inflation by destroying the economy, that would be bullish for bonds and create difficulties for equities. If inflation is allowed to fester or have a structural change higher, that would be bearish for bonds but bullish for equities and commodities. With all these factors to consider, there is a good chance that the Fed could make another policy misstep that has negative implications for asset prices. However, we have already seen significant losses in both equities and bonds so far in 2022. One of these asset classes – or both – will eventually see a reprieve and provide positive returns. As such, investors may want to re-evaluate their portfolios to ensure that they have an asset mix that provides a balanced exposure to various macroeconomic risk factors – including a potential Fed policy error.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.