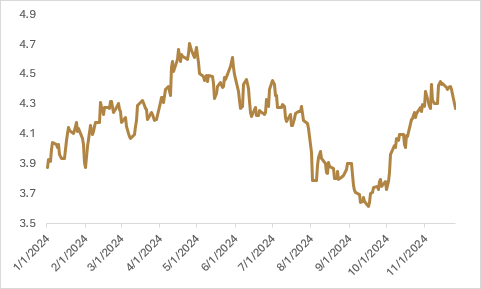

The Board of Governors of the Federal Reserve (Fed) authors a semi-annual financial stability report that assesses the resilience of the U.S. financial system. Included in the report is a survey of financial market participants regarding what they view as near-term risks to the system, and the most recent update that was released a few weeks ago showed that survey respondents were most worried about the sustainability of the U.S debt position. 54% of survey respondents cited fiscal debt sustainability as the main risk to the financial system, with Middle East tensions coming in second at 46%. This contrasts with the previous report that was published in the spring of this year, where the major concern for market participants was persistent inflation (72%) and policy uncertainty (60%). The semi-annual report from the Fed is not something that generally moves markets given its backward-looking nature, but it can highlight trends and sentiment shifts. It’s not a surprise to see this shift in sentiment given that the survey was conducted in the runup to the election, where the economic platforms for both candidates were expected to increase the fiscal deficit. Trump’s tax-cut-focused, pro-growth economic platform—as detailed on the campaign trail—was expected to increase the deficit by a larger amount than Harris’, and after Trump became President-elect with a Republican sweep of Congress, bond yields rose in anticipation of increased debt issuance.

After market close last Friday, President-elect Trump announced the nomination of Scott Bessent for Treasury secretary after a long and drawn-out search for the nation’s top economic policymaker. The nomination of Bessent diverges from other cabinet nominations that have been seen as anti-establishment and likely strengthens the argument that Trump sees the performance of financial markets as a reflection of his own presidential scorecard. Bessent currently runs the macro hedge fund Key Square Group, but he cut his teeth working under George Soros and Stanley Druckenmiller as part of Soros Fund Management, giving him a deep understanding of macroeconomics and international policymaking.

Financial markets have responded favourably to Bessent’s nomination on the perception that Bessent will be a steady hand at the wheel of U.S. economic policy making, along with the fact that he has advocated Trump pursue a “triple three” policy, which amounts to: (1) cutting the budget deficit to 3% of GDP by 2028; (2) spurring GDP growth to 3% through deregulation; and, (3) producing an additional three million barrels of oil (or its equivalent) per day. The advice on reigning in the budget deficit to 3% of GDP has given market participants hope (for now) that there is a voice within the administration advocating that pro-growth policies must also be met with spending cuts to get U.S. debt sustainability on a more manageable path. After the announcement of Bessent’s nomination for Treasury Secretary, many of the market-dubbed “Trump Trades” saw an unwind on a more pragmatic approach to the U.S. deficit. U.S. 10-year government bonds rose by 0.8%, while inflation-hedges like gold and bitcoin fell by -3.5% and -4.5%, respectively.

In addition to U.S. bond yields easing on Bessent’s nomination, the U.S. dollar has also seen some of its upward momentum stall. While it’s no stretch to assume that Bessent would have to be “on-board” with Trump’s tariff policy to have been nominated in the first place, markets are likely viewing the appointment of Bessent as a steadying force in favour of a more surgical approach to hawkish trade policy. Bessent wrote earlier this year that it would be unlikely Trump would implement across-the-board tariffs at the same time as fixing the immigration crisis, and that tariffs would be used as a bargaining tool as opposed to a cudgel, apart from the strategic and national security issues posed by China. Not only has Bessent been quoted as recommending tariff policy be layered in gradually, but Bessent is also of the view that tariffs can be used as an addendum to economic sanctions, levied on countries that are involved in trade with countries under U.S. economic sanctions. Overall, the market is hoping that Bessent’s previous comments will usher in a more strategic use of tariffs that will avoid a larger-scale retaliatory trade war. Given that Bessent has also noted a strong U.S. dollar to begin Trump’s second term will be harmful to U.S. manufacturing from a competitive standpoint, I would opine there will likely be a continued nuance in the implementation of trade policy. Our view is that sledgehammer tariff policy (i.e., across the board tariffs) would strengthen the U.S. dollar in the short term. However, the risk of a trade war escalation that reduces global economic growth and trade will reduce the demand for U.S. dollars and ultimately lead to dollar weakness—something the Trump administration won’t want to see late in their term.

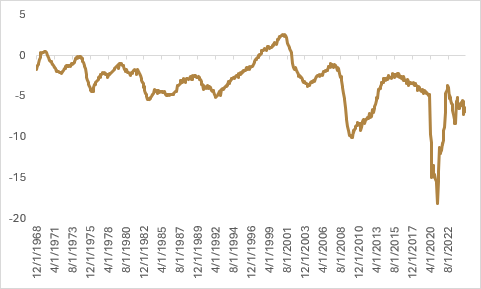

While value stores have seen a bit of an unwind in price on the Bessent nomination, I remain cautiously optimistic about the long-term fundamentals. It does not appear as if economic sanctions will become any less important to the Treasury Department under the leadership of Bessent, and non-Western central banks are likely to continue to diversify their foreign exchange reserves outside of the U.S. dollar and towards gold and other strategic commodities to increase their flexibility. The more challenging assessment for non-yielding value stores will be how progress towards debt sustainability plays out. The notion of reducing the budget deficit from almost -7% to -3% of GDP by 2028 is an ambitious goal, with a two-pronged approach of faster GDP growth combined with leaner spending. Faster GDP growth achieved through tax cuts and deregulation is unlikely to be a stumbling block; the key piece will be how to whip the narrow majority the Republicans hold in Congress (specifically the House) into approving leaner spending plans.

Bessent’s “triple three” policy has a similar tone to the late Shinzo Abe’s “three arrow” policy the former Japanese Prime Minister used to revive the stagnating Japanese economy in the early 2010s. However, the difference is that the American economy isn’t currently stagnating, and Abe’s three arrow policy was centered around monetary policy easing, fiscal spending, and deregulation—a different cocktail of policy than the current prescription for the U.S. economy. While Bessent’s triple three policy is aligned on monetary easing and deregulation, the politics of fiscal tightening are much different than fiscal accommodation and, as such, it will be interesting to see how much progress can be made on more stringent discretionary fiscal spending when domestic investment from legislation like the Inflation Reduction Act has mostly benefited Republican congressional districts.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.