In a historic week, the United States elected Donald Trump as their 47th president, only the second president to be elected for non-consecutive terms after Grover Cleveland in 1893. While not a landslide in relation to Obama’s first term where he won 365 seats and almost 54% of the popular vote, the outcome of last week’s election was a decisive realignment towards Trump’s policies and how they have molded the Republican party over the last eight years. As of this writing, Trump is on pace to win 312 electoral seats, the Republicans gained a majority in the Senate by a larger-than-forecasted margin, and it looks extremely likely that the Republicans will also retain control of the House. In addition to Trump being the first Republican in the last twenty years to win the popular vote, control of both legislative branches will give Trump and his cabinet a strong mandate to enact the polices on which he has campaigned.

The simplest way to play a Trump presidency and a Republican sweep of Congress heading into the election was to be long equities due to tax cuts and deregulation policy that will boost corporate earnings, short U.S. government bonds due to a widening of the fiscal deficit because of these pro-growth policies, and long the U.S. dollar on the potential for across-the-board tariffs. Financial markets responded as expected to the outcome of the election, with the S&P 500 rising by +2.5% in USD terms on November 6th, while the price on the 10-year U.S. bond future fell by -0.8% and the U.S. dollar index rose by +1.6% against a basket of global currencies. With the election being decided in a more decisive manner than both pollsters and betting markets had anticipated heading into last week, the big question on investors’ minds is now the “trade after the trade” and how the implementation of Trump’s policies will affect markets after the dust has settled.

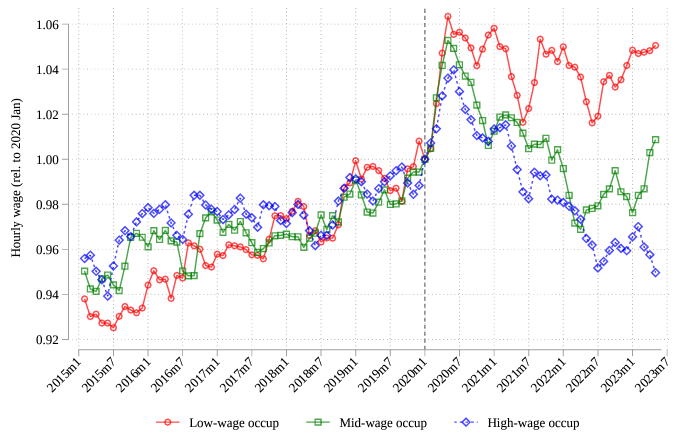

Looking at the exit polls, it is clear that Trump outperformed across almost all demographics, though the big swings in support towards Trump were seen in those who don’t hold a college degree, voters age 18-29, and Hispanic and Latino voters. For those that voted for Trump, the biggest issues were the economy and immigration, whereas the biggest issue for those that voted for Harris was democracy. It’s not surprising that those who voted for Trump were fixated on the economy and immigration, as they were widely seen as “bread and butter” campaign speaking points for Trump and the Republicans. Although the U.S. economy has been performing excellently across several different metrics, the Trump campaign narrative was that wage growth had not kept up with inflation and the working class was falling behind. Not only has free trade led to the exodus of manufacturing jobs, but immigration has expanded the labour pool for low-skilled work, putting downward pressure on wages. This ties into the realignment of the Republican party to be more representative of the working-class voter, who seem to have been abandoned by the Democratic platform. A paper released by the National Bureau of Economic Research (NBER) in 2023 is helpful in viewing how real wage growth for various pay levels has evolved since the pandemic. Although wage inequality for low-wage occupations has narrowed, real wages for mid-wage occupations have essentially remained stagnate since 2020.

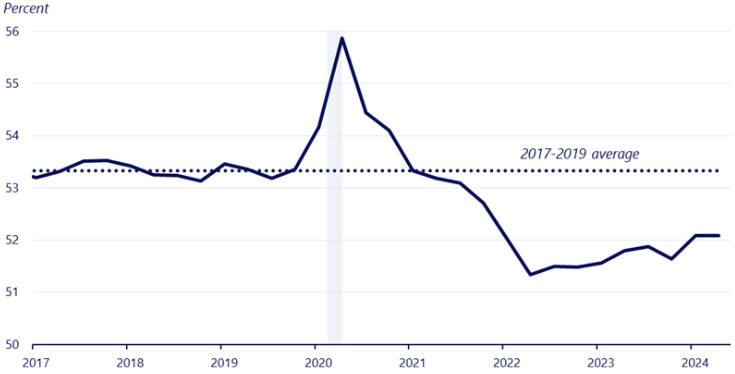

A potential takeaway from this paper is that the path dependency for real wages matters, and the steady decline after the initial post-COVID surge has left many in the working class with a negative view on the economy. Further to this point, the White House’s Council of Economic Advisors (CEA) released a paper last month, outlining that the share of gross domestic income (GDI) attributable to labour remains a percentage point lower than the 2017-2019 average. Although labour’s share of income has been on the rise, it has also experienced a similar path dependency to that of real-wage growth, as evidenced in the NBER paper. The CEA estimates that nominal wages will have to rise by an additional two percentage points above productivity and inflation for that share to get back to the 2017-2019 average.

Trump and his cabinet are likely aware that the economy and inflation are the major catalysts for the shift in support from the working class, and this may eventually act as a headwind to the early Trump trades that have propelled both equities and bond yields higher in the short term. An economic policy platform that focuses solely on tax cuts and deregulation—traditional supply-side economics—could erode the progress that has been made towards wage inequality and labour’s share of GDI. The threat of reigniting inflation without median real wage growth keeping pace would risk alienating support of the working-class voter, and therefore we would opine that Trump will have to pursue more tactical growth policies or, what some might consider, growth at a reasonable cost. In our view, tariff and immigration policy will need to act as a governor to insulate blue-collar jobs and wage growth, though these policies will come at the cost of lower nominal growth relative to the rest of the world. Economists at Bloomberg estimate that if the tariffs Trump has proposed get enacted at even half the magnitude of what has been floated, the average tariff rate on U.S. imports would increase from 2.6% to 8.5% and U.S. global trade share would drop from 20% to 16% by 2028. As it pertains to immigration policy, if Trump begins deportations to remove unauthorized immigrants who have entered the U.S. since 2020, Bloomberg estimates this would result in a population reduction of 8.7 million people, and the U.S. economy would be 3% smaller by 2028. While tariffs and a smaller labour pool are likely to boost consumer prices in the short term, this will be partially offset by slower economic growth as a decline in demand. However, if median wage growth expands at a faster pace to increase labour’s share of GDI, the headline inflation number likely doesn’t matter as much to Trump’s base of support.

The argument against this view is that Trump won’t be running for re-election, and he generally uses the stock market as a barometer of his governing success. Therefore, corporate tax cuts and deregulation could squeeze out some of the more nationalistic parts of the economic agenda. The counterargument to this point is that bond yields may eventually impose a stricter approach to fiscal consolidation, necessitating a pivot back to the tariff and immigration side of the platform. We don’t necessarily see a risk to Trump’s pro-growth policies coming from bond vigilantes at current yields on long-term government bonds, though we expect that if yields breach the 5% level, it will start to become a more serious conversation. Currently, financial market participants are estimating the Federal Reserve’s overnight interest rate will settle around 3.5%, and assuming a normal upward sloping yield curve with a 1.5% spread to the 10-year, that would peg approximate fair value for longer-term yields at 5%. Trump’s pro-growth policies may not allow the Federal Reserve to cut short-term rates by the magnitude that Trump and his cabinet would like, which could set the stage for a fight with the Federal Reserve, given the aggregate maturity of government debt is more skewed to short-term issues and interest payments are a large source of fiscal outlays.

The potential for U.S. growth to eventually downshift based on tariff and immigration policy increases the attractiveness of diversification outside of the U.S. equity market, something that hasn’t necessarily paid for investors over the last decade. As mentioned, bond yields may still have some room to move higher before the bond market vigilantes enforce fiscal consolidation, bringing about a period of relatively slower economic growth due to less fiscal outlays. At Viewpoint, we are firm believers in the benefits of a diversified multi-asset portfolio as the first line of risk management in an environment where macroeconomic uncertainty is high, and we continue to feel that in a climate where fiscal policy can shift quickly based on various political levers, this diversification will be a benefit to investors moving forward.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.