A few weeks ago, I wrote a note on the state of the industrial metals market and how sentiment had been weighed down by sluggish demand out of China. Not only was a slumping property market stoking concerns that Beijing would miss their official growth target, but the upcoming U.S. election could have massive ramifications for the Chinese export industry and whether they will have to contend with higher tariffs on U.S. exports.

Fiscal stimulus measures that would allow homeowners to refinance at lower borrowing rates with state banks had been an idea floated to help boost domestic consumption, but whispers from economists indicated that Beijing would have to do a lot more to stem the negative sentiment that has been hampering economic growth. Early last week, People’s Bank of China (PBOC) Governor Pan Gongsheng held a rare press conference and unleashed a broad range of monetary policy stimulus measures aimed at jumpstarting the Chinese economy. The first salvo of monetary policy stimulus amounted to: cutting the interest rate charged on key policy loans by the most on record, reducing the reserve ratio requirement for banks to help stimulate credit growth, and slashing mortgage rates. On top of the more traditional monetary policy stimulus measures, Pan also announced that the PBOC would create a swap facility of up to 500bn yuan ($71bn USD), allowing financial companies to tap PBOC lending facilities in order to buy equities.

The stimulus measures from the PBOC last week helped onshore Chinese equities rally the most since mid-2020, with additional support from reports that China’s sovereign wealth fund was also a heavy buyer of Chinese ETFs. If all this monetary policy stimulus wasn’t enough to spur investor risk appetite, President Xi Jinping and Politburo followed up the PBOC announcements where Politburo officials “pledged action to make the real estate market ‘stop declining,’ their strongest vow yet to stabilize the crucial sector.” The statement from the Politburo almost had a Mario-Draghi-like feel to it, akin to when the then-head of the European Central Bank gave his now famous speech during the European debt crisis in 2012, pledging that the central bank would “do whatever it takes to preserve the euro. And believe me, it will be enough.” After Draghi’s speech in the summer of 2012, the euro would go on to appreciate by roughly 10% against the USD. While the Politburo’s statement didn’t make any mention of specific fiscal spending, Reuters reported that the Ministry of Finance is planning to issue two trillion yuan of special sovereign bonds ($284bn USD), split evenly between stimulating consumption and helping local governments tackle debt problems.

Back in February, I wrote a note about the Chinese equity market and how U.S. hawkish foreign policy towards China combined with policymakers stepping back from “bazooka-style” stimulus measures created outsized risk for how “cheap” perceived valuations were in the region. Adding in the fact that Chinese economic growth doesn’t necessarily mean outsized returns to shareholders, investing in the region had become more complicated.

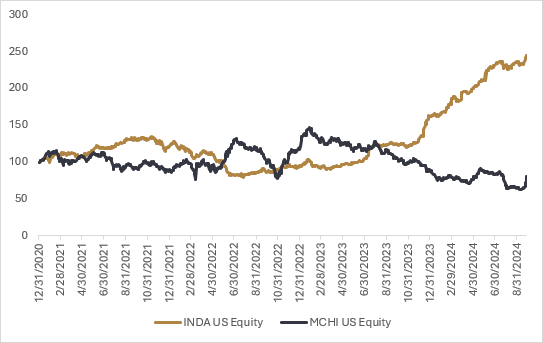

It’s no secret that Chinese equities have struggled this year relative to developed market equities. Onshore equity markets like the Shanghai Composite and the Shenzhen 300 had fallen by -4.7% and -3.4% respectively in USD terms year to date (to September 20th). While offshore equity markets like the Hang Seng and MSCI China fared better at +11.9% and +6.4% respectively in USD terms, they have fallen short of the S&P 500 that gained +20.8% over that period. However, Chinese policymakers seem to have reached their limits on how much pain they are willing to tolerate and have thrown the proverbial kitchen sink at revitalizing domestic consumption.

The initial stimulus salvo has Chinese equities now encroaching on a new bull market, with the Shanghai Composite and the Shenzhen 300 having rallied +13.4% and +16.3% respectively in USD terms from September 20-30th. For investors that have a high tolerance for risk, a short-term tactical trade to take advantage of the short-squeeze momentum in Chinese equities would make sense, given the swatch of stimulus measures aimed at boosting the Chinese economy.

The last few years have seen a mass exodus of assets from China to India within emerging market mandates and it’s not too far of a stretch to see a reversion of flows, given somewhat of a floor that policymakers have established for equity investors. This is obviously a higher-risk trade looking to capitalize on improving investor sentiment towards China, and I would highlight that it is still too early to be confident in increasing strategic policy weights back in favour of Chinese equities.

Geopolitical risk from the upcoming U.S. election continues to linger, and even if trade policy remains status quo, that doesn’t mean economic tensions between the U.S. and China are on the verge of thawing. For more risk-adverse investors who would prefer to steer clear of investing directly in Chinese equities, I would prefer to play this “Mario Draghi whatever it takes” rally through either European or Japanese equities, which have a higher beta to Chinese economic growth than North American equities, or through the industrial metals space based on an up-tick in Chinese demand. Copper, aluminum, and nickel futures have all seen a boost in prices over the last week, with the metals rallying +4.7%, +5.0%, and +5.9% respectively.

The forceful actions last week from the PBOC followed up by support from the Politburo should be a welcomed adrenaline shot for domestic Chinese consumption that will help to support global growth. Later this week, we’ll get additional information on the U.S. labour market and more data on whether the Fed is cutting into what we would consider is a “speedbump” for global growth as opposed to a “pothole.” For now, the tactical call back in June to start lengthening duration into a softer labour market and impending interest rate cuts from the Federal Reserve (Fed) has worked out well, as U.S. 10-year bond futures have outperformed two-year futures by about +2%, but a strong labour market survey this week may signal that we’re getting closer to reducing duration in anticipation of yield curve normalization through a steepening in the long end.

We continue to believe that the path towards the Fed’s neutral interest rate (which they recently forecast at their last policy meeting to be just under 3%) will be bumpier than markets are anticipating and that duration will struggle if a recession doesn’t materialize. In a normal upward sloping yield curve with an overnight rate of 3%, that would suggest 10-year yields should clock in around 4.5%, which is 1.25% above where they currently sit.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.