In the ever-evolving landscape of real asset investments, fund managers seek strategies to enhance portfolio resilience and performance. A compelling opportunity lies in the strategic allocation to direct commodities. This approach offers several advantages that align closely with the objectives of real asset funds, particularly those aiming for robust inflation protection, liquidity management, and diversification. This note explores the benefits of utilizing direct commodity exposure* via futures markets within a real asset portfolio, highlighting its role in achieving these objectives.

Inflation Armor: The Inflation Beta Argument

Inflation protection is a cornerstone objective for most real asset funds either implicitly or explicitly as a return target above the Consumer Price Index (CPI). As the raw material input into many goods and services, we can hypothesize that commodity price increases will have a positive relationship with increases in inflation. We can hypothesize further that these price increases will actually lead inflation, as commodity price increases impact costs early in the value chain when compared to the actual consumption that makes it into the Consumer Price Index (CPI). Using U.S. CPI and the Bloomberg Commodities Index—a broadly followed, diversified commodity index—we can calculate an estimate of the inflation beta** for direct commodities. Beta is a handy tool because it gives us a sense of the directionality and magnitude of a relationship between two variables. In this case, the concurrent beta coefficient for direct commodities with respect to inflation is 2.34, meaning that if U.S. CPI increased by 1% in a month, we’d expect the commodity index to increase by 2.34% on average during that month. This confirms our hypothesis that commodities have a positive relationship to inflation. Additionally, if we were to simply lag the commodity index return by a month and recalculate beta to test the hypothesis that commodity prices actually lead inflation, we find a beta of 5.8, meaning the magnitude of the relationship may actually be 2.5 times larger than initially thought after accounting for the temporal relationship between raw material prices on end consumer prices.

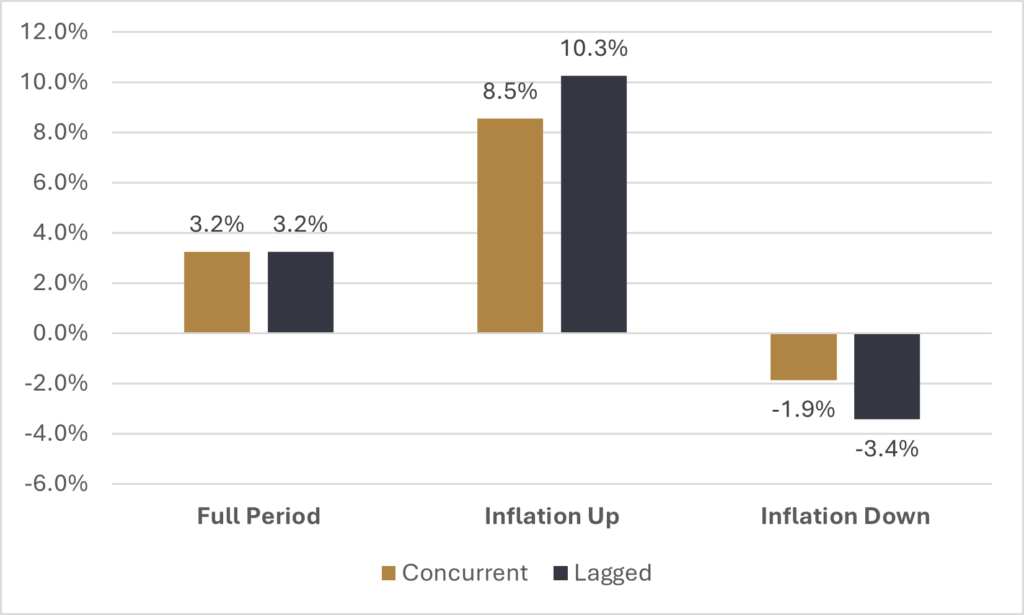

A comprehensive paper published by Levine et al. in affiliation with AQR confirms that direct commodities historically have a strong positive correlation with CPI in the U.S. The study looks at over 150 years of data to draw these conclusions and shows how direct commodities are a natural fit for funds aiming to maintain purchasing power amidst inflationary pressures. Using the data that was made available by AQR, we can compute the compounded annual growth rate (CAGR) on an equal weight commodities portfolio conditioned on the state of the monthly inflation environment going back to 1877. The results in Figure 1 show that on a concurrent basis, commodities return an 8.5% real CAGR during inflationary months. And, just as we found in our analysis of inflation beta, the effect is more pronounced when we lag the commodity real return data by one month, giving us a 10.3% real CAGR.

Stepping back, we can consider some of the fundamental rationale for the strong positive inflation beta exhibited by direct commodity exposure. Commodity prices, like any other asset, are governed by supply and demand pressure. However, unlike traditional assets, this supply and demand is not driven by market participants’ assessment of future cash flows, but rather a natural equilibrium based on the requirements of specific commodities as inputs into production of goods and services and the estimated availability of these physical commodities to meet these requirements. In this way, commodities exhibit intrinsic value as they are fundamental to economic activity. From crude oil powering industries to precious metals being pivotal in manufacturing and technology, their prices naturally escalate with inflation. This intrinsic link to the broader economy reinforces their role as an effective inflation hedge during demand-driven inflation. Conversely, during economic downturns, supply constraints or geopolitical factors can spike prices. In the current environment, factors like deglobalization risk and the chronic underinvestment in commodity production over the past two decades are both examples of variables that can cause supply-side shocks and ultimately inflationary pressures, even in the absence of economic growth. This responsiveness ensures that commodities remain a viable hedge regardless of broader economic conditions. Unlike financial assets whose values may be eroded by inflation, commodities like oil, gold, and agricultural products tend to appreciate, preserving purchasing power.

Liquid Fortresses: Balancing Liquidity & Inflation Exposure

One of the primary challenges in constructing an inflation-sensitive portfolio is balancing liquidity needs with genuine inflation protection. Most real asset funds focus much of their portfolio in illiquid assets, as this is generally the best way to gain exposure to inflation sensitive investments, such as infrastructure, real estate, and farmland. However, it’s nearly impossible for these strategies to have 100% of their capital invested in illiquid assets for two main reasons:

- Many of these funds are open-ended and therefore need to be able to fund a redemption or put newly subscribed capital to work.

- Many private investments draw capital from investors over time in the form of cash calls and so liquidity is required to fund these ongoing obligations.

Unlisted securities don’t afford these funds enough flexibility to do this, and therefore most fund managers have to turn to exchange-traded or otherwise liquid assets. There are a few options that managers can utilize to meet these liquidity requirements, all with varying trade-offs:

Listed Equities for Commodity Producers

While offering some exposure, equity investments in commodity producers often come with high equity beta, which can dilute their effectiveness as pure inflation hedges. For instance, during market downturns, commodity equities tend to move in tandem with broader equity markets, thus failing to provide the desired inflation protection. Moreover, commodity producers engage in hedging activities for their production and also face input costs that are subject to inflation, limiting their ability to act as an inflation pass-through. This scenario can result in suboptimal performance of commodity equities during inflationary periods.

Short-Term Government Bonds

Cash equivalents or near-cash equivalents can be a viable place to park capital, as rates at the short end of the yield curve often rise with inflation, leading to higher reinvestment rates and returns that could potentially keep up with inflation. However, this serves as cash drag, especially for funds with a return target above inflation.

Inflation-Linked Bonds

Despite their name, inflation-linked bonds generally have poor performance during inflationary periods. They outperform their nominal counterparts when inflation surprises to the upside. However, duration—which has a significantly negative inflation beta—remains the key risk factor in these instruments.

Direct Commodity Futures

Direct commodities, unlike commodity equities, strip out the equity beta to ensure that inflation exposure is more purely accessible without having to rely on what is ultimately an inconsistent inflation pass-through. They provide the necessary liquidity to manage inflows, outflows, cash calls, and distributions without compromising on the primary objective of inflation protection due to their high inflation beta. However, many investors may shy away from commodities due to the added complexity of trading derivatives and the lack of expertise and understanding of the space, both of which can be mitigated in part by utilizing a high quality manager or index product for this exposure.

The Perfect Partner: Enhancing Portfolio Synergy

As mentioned, real asset funds typically include a diverse mix of holdings, such as real estate, infrastructure, timber, farmland, and global transportation. These investments, while offering valuable returns and stability, are also subject to rising costs of raw materials. Here, commodities can play a crucial role by hedging against these rising costs, protecting the broader portfolio. This report by Milliman, which focuses on the need for real assets—such as infrastructure investments as an important component in portfolios in order to hedge inflation—highlights commodity prices as a key risk in these assets’ ability to deliver a reliable inflation hedge. As an example, infrastructure projects are heavily reliant on commodities like steel and copper. Rising prices of these raw materials can erode profit margins and increase project costs. By incorporating direct commodities into the portfolio, managers of real asset funds can effectively hedge against these price increases, safeguarding the profitability of infrastructure investments.

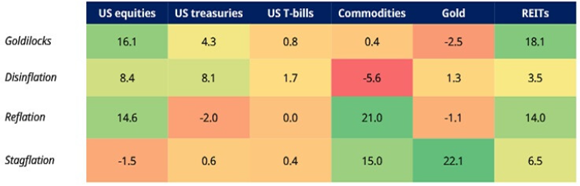

In stagflationary environments—characterized by stagnant growth and high inflation—traditional real asset investments may suffer. Commodities, however, often perform well in such conditions. Historical instances, such as the 1970s stagflation period, demonstrate that commodities can thrive when other assets falter, providing an essential counterbalance within the portfolio. Between 1970 and 1980, the equal weighted commodity index constructed by Levine et al. provided an annualized real return of 7% compared to -1% and -3% for U.S. Stocks and U.S. Bonds over the same time period. Figure 2 below, sourced from a report by Shroders, shows that during past periods of stagflation, commodities have shown strong performance, outpacing many other asset classes and providing effective hedging benefits.

Final Takeaways

Incorporating direct commodities into a real asset fund can significantly enhance its inflation-hedging capabilities, liquidity management, and overall resilience. Direct commodity exposure can provide a direct hedge to some of the key risk factors within other components of typical real asset funds, such as raw input costs. Additionally, while many real assets are dependent on economic growth drivers of inflation, commodities have the unique ability to also perform during stagflation, as they are responsive to supply-side inflationary shocks, providing further diversification to real asset portfolios.

Sincerely,

Amin Haji

Senior VP, Investment Research

*Direct commodity exposure can refer to the physical holdings of various commodities or, more commonly, exposure through futures contracts to the underlying commodities. Stockpiling of physical commodities isn’t common practice, outside precious metals, and drastically reduces the liquidity of the investment, which is often a key feature.

**Inflation beta refers to the measure of how much a particular asset’s returns are expected to change in response to a change in the rate of inflation. It quantifies the sensitivity of the asset’s performance to inflation. A high positive inflation beta indicates that the asset’s returns are positively correlated with inflation, making it a potentially effective tool for protecting purchasing power in inflationary environments.

***Growth is proxied using U.S. Conference Board Leading Economic Index and inflation is U.S. core CPI.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.