If you thought the current macroeconomic landscape wasn’t interesting enough (e.g., ongoing geopolitical conflicts, election uncertainty, etc.), we can now add an influenza outbreak to the 2024 bingo card. In late March of this year, the United States Department of Agriculture (USDA) detected an outbreak of highly pathogenic avian influenza (HPAI H5N1), known informally as “bird flu,” in dairy cows. Over the last few years, there have been reports of HPAI H5N1 spreading from birds to mammals, but this was the first outbreak of the virus in dairy cows.

While the influenza outbreak hasn’t yet gained the ability to spread directly between humans, there have been three infections of people working with dairy cows. In early June, the World Health Organization (WHO) reported that a person with prior health complications contracted bird flu in Mexico and later died. The diary workers in the United States that have been infected with the bird flu have only experienced mild symptoms, which is an optimistic development given that bird flu has a mortality rate of 52%. Now, it’s also likely that only severe cases get reported to the WHO, therefore leading to a higher reported mortality rate; however, the ability of H5N1 to spread from dairy cows to humans is somewhat concerning. The U.S. Centers for Disease Control and Prevention (CDC) have said the risk to the public is currently low, though as more infections crop up among dairy cows, the more risk there is for transmission to occur among humans. The CDC data currently shows that there have been 90 dairy herds across 12 states in the U.S. that have been infected. Although the current H5N1 outbreak hasn’t shown the ability to spread from human to human, the concern is that more human infections could occur through the consumption of raw milk that has been infected with H5N1. The National Institutes of Health (NIH) have suggested that pasteurized milk purchased from grocery stores poses no risk to humans, given the milk has been heated to temperatures hot enough to kill most viruses or bacteria. However, there are 30 states in the U.S. that allow for the sale of raw dairy milk in some form.

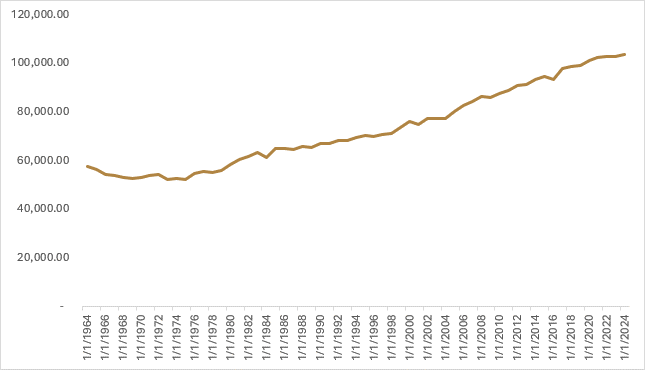

While it doesn’t appear that the human health risk is currently high, there could be some implications for commodity markets. When the outbreak was originally reported, there was both a bullish and bearish argument for how the bird flu outbreak could affect milk prices. The bearish argument is that people are concerned about human infection through the consumption of milk from cows infected with H5N1 and demand for milk decreases. While it would take some time for sentiment to flow through into the data, the USDA is forecasting that milk consumption in the U.S. for 2024 will increase by 0.9% relative to 2023, which is below both the long-term growth rate of +1.0% and the growth rate over the last 10 years of +1.2%. On the bright side of the demand picture, international demand has been improving and milk solids exports set a record in February.

The bullish argument for milk futures is that dairy cows infected with the bird flu suffer from digestive issues and diminished appetite, resulting in a drop of their milk production. At the onset of the outbreak, the reported symptoms in cows were mild, and it was assumed that many cows would recover from the flu. However, incoming reports are now suggesting that the economic toll on milk production could be greater than initially thought. Farms in South Dakota, Michigan, and Colorado are reportedly culling some of their herds, because some of the infected cows have not been able to return to milk production.

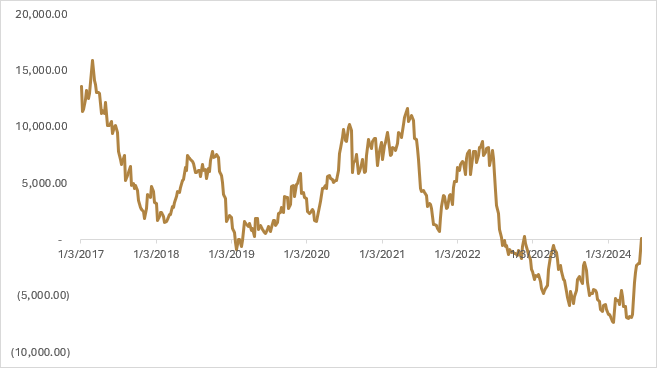

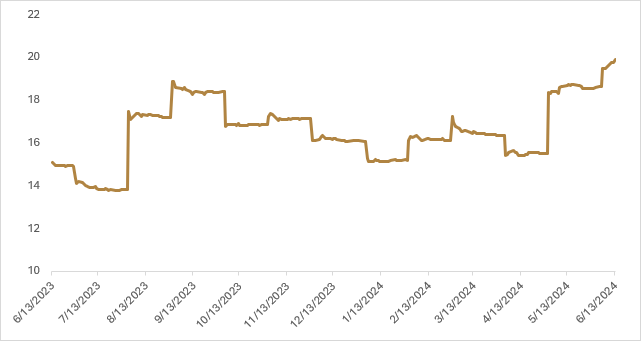

Though we haven’t seen a dramatic decline in milk production in the U.S. yet, Class III Milk futures are starting to reflect an uncertainty premium surrounding the potential for future supply shortages. Class III Milk futures have risen +23.5% year to date, with a notable bump in price since early May. Volatility has also increased reflecting the uncertainty of the influenza situation, with daily annualized volatility over the last year rising to 38.5%, an increase from the long-term volatility profile of 32.7%. The recent rise in prices looks to be partially explained by a reduction in net short futures positions from speculative participants, likely not wanting to be caught short should a more pronounced supply shock occur. Near the end of April, speculative participants were short almost 7,000 contracts, and that has now flipped to a small, long position.

While an outbreak of highly pathogenic avian influenza wasn’t on our bingo card for 2024 and is also not a part of our secular bull case for commodities, this will be an interesting development to monitor.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.