Inflation data and the Federal Reserve’s (Fed) interest rate decisions are arguably two of the biggest announcements on the recurring economic calendar, with employment data rounding out the “big three.” The monthly inflation report for the U.S. has only coincided with the Fed’s interest rate announcement 13 times since 2008, so it’s a rare occurrence when any of these market movers overlap, but today was one of those lucky days.

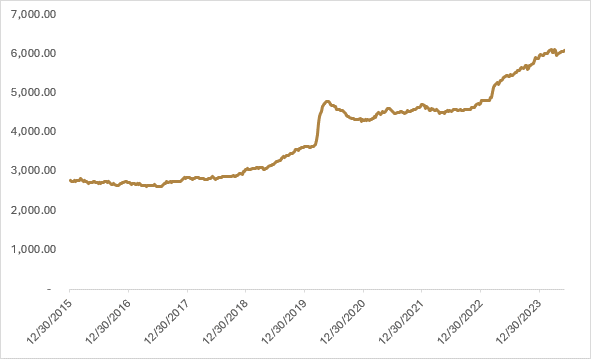

Last Friday’s U.S. employment report has sent bond yields spiking after a larger-than-expected growth in payrolls, so market participants were bracing for another potential bout of volatility should inflation come in warmer than anticipated. Before getting into the May inflation figures, it’s worth discussing the U.S. employment report from last Friday, which had some interesting tidbits for both the bulls and bears. On the side of a robust labour market, the establishment survey exhibited an increase in nonfarm payrolls by +272k, much higher than the +180k gain economists had expected. Average hourly earnings also increased by +4.1% on a year-over-year basis, surpassing expectations of a +3.9% pace. On the side of a slackening labour market, the household survey showcased that the unemployment rate increased from +3.9% to +4.0%, while the U.S. job openings data from earlier in the week showed that openings fell to the lowest level in three years. The increase in the unemployment rate to +4.0% also brings us closer to triggering the Sahm Rule, which is a recessionary indicator that is triggered when the three-month moving average is 0.5% above the minimum of the three-month averages from the previous 12-months; the current gap is +0.4%.

You could make the argument that with unemployment at +4.0%, this would be sufficient for the Fed to start cutting rates. Back in March when the Fed released their last summary of economic projections (SEP), they had forecasted the unemployment rate to increase to +4.0% by the end of 2024, while also forecasting that they would be able to cut rates three times during the year. Economic data since March has ratcheted back the magnitude of interest rate cuts that we’re likely to see from the Fed. However, if the slack in the labour market holds, we’re homing in on what the Fed likely sees as their “sweet spot.” However, the “two-faces” to May’s employment report make the discussion around these numbers all that more nuanced. While the establishment survey (i.e., survey of businesses to generate payroll and wage data) was strong, the household survey showed a loss of -408k jobs and an increase in the unemployment rate to +4.0%. The Bureau of Labour Statistics (BLS) put out a press release last week that they would be cutting the size of the household survey by 5,000 households beginning in 2025, citing increasing survey costs. Last week, Kyla Scanlon highlighted the challenges with relying on volatile survey data for ascertaining the health of the labour market, noting that budget constraints for the BLS may be creating a jobs data problem, which in theory could create more volatility in the reported unemployment rate as less households are being surveyed on a go-forward basis.

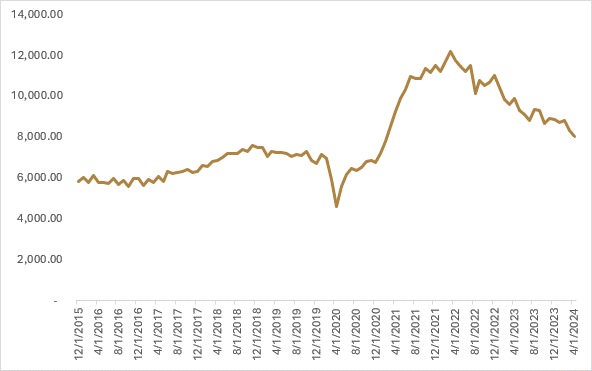

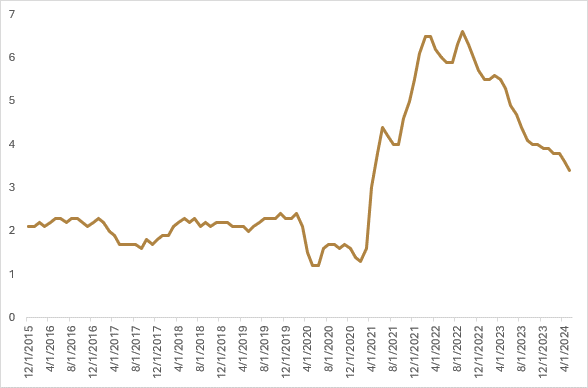

Despite the softer household survey, bond yields spiked at the end of last week as market participants were more intently focused on the strong establishment survey. However, the spike in bond yields has now been fully unwound, as weaker-than-anticipated inflation figures released today have buoyed market sentiment. May core inflation figures came in at +3.4% on a year-over-year basis, softer than the +3.5% that economists had expected and down from the +3.6% pace in April. Core goods posted their fifth deflationary print in a row, while shelter costs saw a slight moderation from the April numbers. If you take shelter costs out of the inflation figures, core CPI is running at a 1.9% year-over-year pace. On balance the CPI report was well received by the markets, with market participants increasing the probability of rate cuts from the Fed this year from one to two. U.S. equities and U.S. bonds rose in tandem by roughly +1.0% each after the CPI release, while gold jumped +1.2% and the USD fell against a basket of global currencies by -0.9%.

The decently dovish inflation reading was not followed up with an equally dovish Fed rate decision. Instead, Jerome Powell and Co. executed what could be interpreted as a slightly hawkish hold. To be fair, had the inflation reading been tomorrow instead of today, the Fed rate decision and their summary of economic projections (SEP) would have been in-line with market expectations prior to this morning. The Fed kept interest rates steady at 5.25-5.5%, but the key area on which market participants were focused was the SEP dots and how the Fed members saw monetary policy evolving for the remainder of this year. On the hawkish side of the ledger, the median dot for where the Fed expects interest rates to end in 2024 signified only one cut this year, which is of course lower than what the market is currently anticipating and down from the three cuts they had forecasted as part of their March SEP. Some of the anticipated rate cuts from March have been pushed out to 2025, but the Fed now expects interest rates to settle higher in 2025 at +4.2% versus the +3.9% they expected three months ago. Powell also commented during his press conference that while today’s inflation report was a good sign of progression, there had been an easing of price pressures near the back-half of 2023 that will soon be rolling off the year-over-year data, so the Fed would like to see more positive progression in inflation before lowering interest rates.

While I would categorize the Fed’s SEP and Powell’s press conference as neutral to slightly hawkish, the market shrugged off these developments and has continued to price in two interest rate cuts this year. The earlier rally in stocks, bonds, and precious metals eased slightly after the Fed meeting with the USD recouping some of its lost ground, but on balance it was a positive day for financial markets. With respect to what this all means going forward, I think the setup is conducive for positive performance in both stocks and bonds over the summer and into the early fall before the election cycle heats up. For the last year, market participants have over-estimated the timing and magnitude of rate cuts to be delivered by the Fed, but with some slack starting to appear in the labour market, beginning to lengthen duration back to benchmark makes sense given the balance of probabilities is that we do see a rate cut from the Fed this year. My longer-term view is that interest rates will be higher for longer and higher than the neutral rate has been in the past. A continued focus on fiscal policy to reindustrialize supply chains and further movement towards protectionism in a multi-polar world (just look at the E.U. elections this week) are supportive of higher interest rates in the long term. We currently don’t ascribe to a recessionary hard landing being the highest probability outcome in the next six months and believe the higher probability is that interest rate cuts from the Fed could spur additional inflows into financial markets as cash on the sidelines get puts to work, which could then reinvigorate economic growth and make the interest rate path back down to neutral one that is longer and bumpier than the market is anticipating.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.