As we enter 2026, financial markets are being shaped less by any single economic narrative and more by the interaction between monetary policy, fiscal policy, geopolitics, and late-cycle dynamics. U.S. growth remains constructive even as employment softens, and productivity gains continue to support corporate earnings and equity valuations. At the same time, policy choices heading into the midterms point to a clear preference from the U.S. administration to keep the economy running hot. Continued pressure on the Federal Reserve to lower interest rates, targeted affordability measures, and fiscal expansion all reinforce an environment that remains supportive for risk assets, albeit increasingly uneven beneath the surface.

While time in the market remains a powerful ally for long-term investors, late-cycle conditions demand greater discipline. The opportunity set in 2026 is likely to reward selectivity, adaptability, and resilience over broad market beta, as policy support and economic momentum become less evenly distributed.

Financial markets took a brief pause in December, but 2025 was another solid year for asset holders. Global equities absorbed early-year trade-war concerns and ultimately moved higher, driven by continued enthusiasm around artificial intelligence and resilient consumer spending that helped support corporate earnings and balance sheets. Commodities delivered similarly strong performance, with precious and industrial metals leading the way, as supply-chain security and geopolitical tensions reinforced the strategic importance of natural resources in a multipolar world.

Global bond markets were more mixed, as expanding fiscal deficits limited any sustained decline in yields, but the asset class nonetheless finished the year in positive territory—a welcome outcome given the macro and policy backdrop.

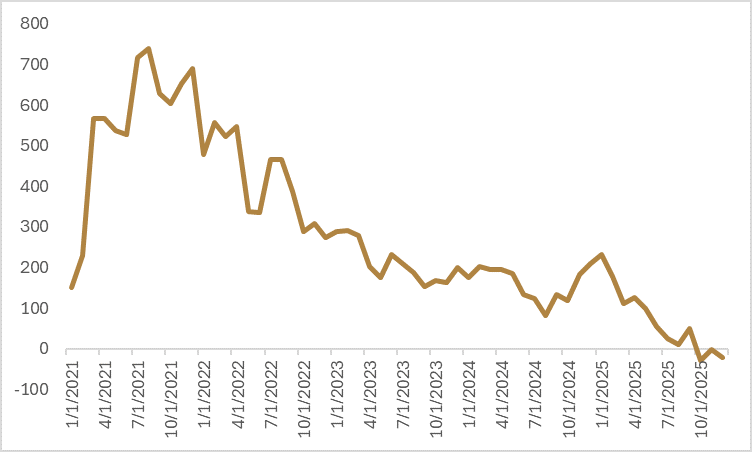

The macroeconomic trends that defined 2025 appear set to carry into the new year, though with heightened geopolitical risk and equity valuations that increasingly reflect late-cycle dynamics. U.S. economic growth remains robust, with the Atlanta Fed’s GDP estimate for the fourth quarter currently tracking at a 5.1% annualized pace. However, beneath that headline strength, the labour market continues to cool, and consumer sentiment has begun to weaken.

This softening has given the Federal Reserve room to ease monetary policy, but it has also brought the dynamics of a K-shaped economy into sharper focus. Productivity gains and stock market appreciation continue to benefit higher-income households and asset owners, while lower-income cohorts face tighter credit conditions, higher borrowing costs, and persistent affordability pressures across housing and essential goods.

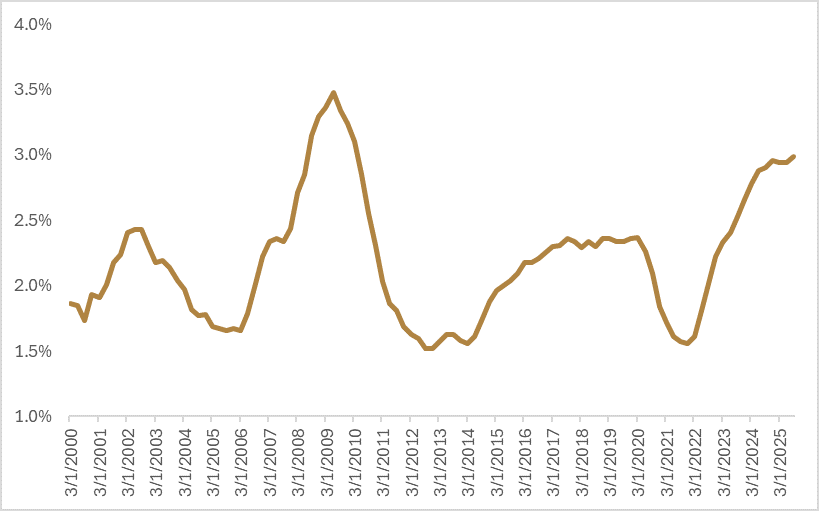

On the surface, household balance sheets still appear reasonably healthy. Debt-service costs as a share of disposable income have risen over the past year but remain close to long-term averages and well below pre-2008 levels, while aggregate household net worth continues to benefit from strong equity markets and higher asset prices. But averages can obscure the tails.

Beneath the headline figures, delinquency rates are rising across student loans, lower-score credit cards, and auto loans, particularly among younger and lower-income households. The result is a bifurcated consumer backdrop in which the median household appears stable, but a growing segment is beginning to experience meaningful strain from higher borrowing costs and weaker affordability.

This K-shaped consumer dynamic is not, by itself, a clear pre-recession signal, but it does argue for a slower and more uneven growth path. For investors, the key question is whether stress at the lower end of the credit spectrum begins to migrate toward prime borrowers. If that pressure moves up the quality ladder, the risk of a consumer-led growth scare becomes materially higher—something both central banks and policymakers will be watching closely as the midterms approach.

With the economy, trade, and inflation all polling poorly for the administration, domestic affordability has become an increasingly important policy focus, particularly for voters on the lower arm of the K. While U.S. foreign policy has dominated headlines early in 2026, the administration has taken several steps aimed at easing housing affordability.

Following late-2025 discussions around the introduction of 50-year mortgages, the administration announced plans to restrict asset managers from owning single-family homes, seeking to reduce institutional demand in the housing market. At the same time, Fannie Mae and Freddie Mac have been instructed to purchase $200 billion of mortgage-backed securities, an effort to put downward pressure on mortgage rates and reduce borrowing costs for prospective homeowners.

In our view, neither initiative is likely to materially improve affordability on its own. These measures do little to address the core constraint in the housing market: the trapped supply from existing homeowners with mortgages far below prevailing market rates. Without a mechanism to unlock that inventory, affordability gains are likely to remain limited, suggesting that mortgage portability may ultimately be a more effective structural solution.

Encouragingly, the administration has also begun to explore supply-side remedies. Commerce Secretary Howard Lutnick has recently engaged with major homebuilders to discuss potential incentives to accelerate construction, which could help ease housing shortages over time and have a more durable impact on affordability.

Beyond housing, the administration has also proposed a one-year cap on credit-card interest rates at 10%, aimed at reducing borrowing costs for consumers. While the intent is to ease financial pressure, price controls in consumer credit could produce unintended consequences. If lenders are unable to adequately price risk, traditional financial institutions may respond by tightening credit availability, particularly for higher-risk borrowers.

That outcome could ultimately harm the very households the policy is meant to support, pushing some consumers toward more expensive alternatives such as payday lending and exacerbating stress on the lower arm of the K.

The implications are not limited to lower-income households. For higher-income consumers, reduced profitability across credit-card portfolios could lead to weaker rewards and loyalty programs, diminishing the value proposition of traditional credit cards. In that environment, we could see increased adoption of “buy now, pay later” structures as households seek greater flexibility in managing cash flows, especially if credit-card benefits are diluted. As with other affordability initiatives, the policy intent is clear, but the transmission to outcomes is likely to be uneven.

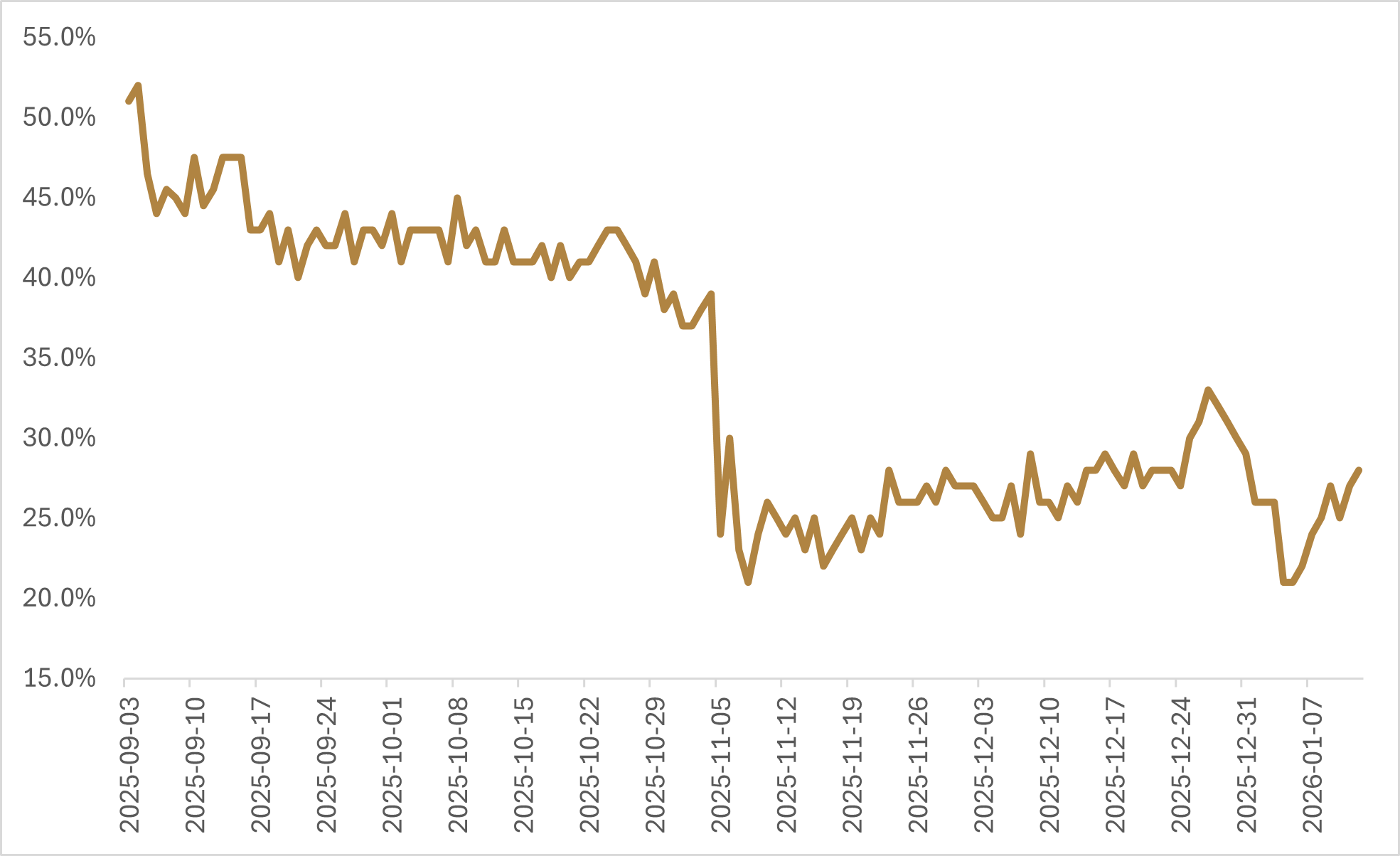

Separately, and largely outside the administration’s direct control, markets are awaiting a Supreme Court ruling on the legality of President Trump’s use of the International Emergency Economic Powers Act (IEEPA) to implement broad-based tariffs. There is a meaningful possibility that significant elements of the current tariff framework are rolled back or reshaped.

If the Court were to rule that IEEPA cannot be used to justify sweeping tariffs—an outcome that appears increasingly likely—the effective U.S. tariff rate could fall from the mid-teens back toward single digits, at least temporarily, until the administration identifies a narrower legal pathway.

In practice, this would amount to incremental tariff relief. We have already seen a growing number of carve-outs and exemptions, including recent relief on certain agricultural products, signalling a heightened policy focus on affordability. Our base case is that peak tariff uncertainty is now behind us, with tariffs evolving toward a more targeted, revenue-oriented tool—closer in function to a value-added tax—and increasingly used as leverage in geopolitical confrontations with non-aligned countries.

Taken together, the administration’s recent policy initiatives point to a clear focus on affordability heading into the midterms, even if the effectiveness of individual measures remains uncertain. Combined with proposals to increase the defence budget by roughly $500 billion to $1.5 trillion, and Treasury Secretary Scott Bessent’s public comments suggesting the Federal Reserve should consider an inflation target range, the broader message is unambiguous: the U.S. remains firmly in a “run-the-economy-hot” policy regime.

Consistent with that stance, pressure on the Federal Reserve to lower borrowing costs has intensified, most recently through a Department of Justice (DOJ) investigation into Chair Jerome Powell’s congressional testimony regarding renovations to Federal Reserve buildings.

We have previously noted the administration’s desire to reshape the Federal Reserve’s leadership over time. While removing a sitting governor for cause would face significant legal hurdles—and makes the removal of Governor Lisa Cook and Chair Jerome Powell unlikely—the administration will soon be demoting Powell from his role as Chair when it expires in May. Powell’s term as a governor runs until 2028, meaning he could remain on the Board even after a new Chair is appointed, unless he resigns.

Given Powell’s response to the DOJ probe, we view it as unlikely that he would resign before his term as governor ends. In that context, appointing a new Chair aligned with the administration’s policy preferences—our base case remains Kevin Hassett—would require filling the upcoming vacancy created by the expiration of Stephen Miran’s term at the end of January.

Replacing one administration-aligned governor with another does little to immediately alter the balance of the rate-setting committee, underscoring why the administration’s broader objective appears focused on gradually shifting the composition of the Board over time.

In the near term, these efforts are likely to encounter political resistance. There appears to be sufficient Republican pushback within the Senate confirmation process to limit the administration’s ability to rapidly reshape the Federal Reserve’s leadership. Senator Thom Tillis has stated that he would oppose advancing any new Fed governor nominations until the Department of Justice investigation is resolved, effectively slowing the confirmation pipeline. As a result, the immediate market impact of the DOJ probe is likely to fade.

That said, this episode reinforces our broader concern around institutional credibility. Persistent pressure on previously independent institutions—even if ultimately constrained—raises questions for international investors about policy predictability and precedent. Over time, this dynamic supports our view that the U.S. dollar remains vulnerable, as capital becomes more sensitive to governance risk and seeks diversification away from assets where institutional independence is increasingly contested.

Looking ahead, the prospect of further reductions in the overnight lending rate is likely to act as an early-year catalyst for markets. However, with futures markets currently pricing only two additional rate cuts in 2026, we expect investor focus to gradually shift away from monetary policy and toward corporate earnings as the year progresses. In a late-cycle environment, earnings durability and margin resilience are likely to matter more than incremental changes in policy rates.

The combination of easier monetary conditions and continued fiscal support remains constructive for equities and select commodity sectors, particularly precious and industrial metals. The outlook for fixed income is more mixed. While lower policy rates provide some support at the front end of the curve, persistent fiscal deficits will be a challenge for longer-term yields.

Because long-term rates feed directly into mortgage costs and broader affordability conditions, the administration will need to balance pressure on the Federal Reserve with the risk that excessive fiscal expansion pushes yields higher, potentially undermining its own objectives.

The developments of the past six months have reinforced our existing asset-class views rather than prompting a wholesale shift in positioning. We continue to see a late-cycle environment that remains supportive for equities, though with an increasing emphasis on selectivity. In common-currency terms, we prefer international and emerging market equities over U.S. equities, where valuations are more extended and concentration risk remains elevated.

From a factor perspective, late-cycle dynamics argue for a gradual rotation away from pure growth exposure toward value and quality, helping to fortify portfolios against potential disruptions to the AI-led, mega-cap equity theme.

Geopolitical fragmentation and supply-chain reorientation continue to underscore the strategic importance of commodities within diversified portfolios. We maintain an overweight to commodities, with particular attention to areas where supply constraints and policy risk are most acute. This positioning is paired with a relative underweight to fixed income, where the path to meaningfully lower yields remains challenged by persistent fiscal deficits.

While fixed income retains value as a defensive asset when growth risks materialize, we view the allocation as more tactical than strategic at this stage of the cycle, given the likelihood that fiscal policy support ultimately expresses itself through higher yields and/or a weaker U.S. dollar.

The defining feature of the 2026 investment landscape is not the absence of growth, but the growing divergence between policy support and underlying economic realities. Governments remain inclined to run economies hot, central banks face increasing political pressure, and geopolitical fragmentation continues to reshape supply chains and capital flows.

In such an environment, markets are unlikely to reward complacency. Returns will be driven less by passive exposure and more by an investor’s ability to adapt across geographies, asset classes, and factors as conditions evolve.

For long-term investors, this reinforces a familiar but increasingly important lesson: time in the market is more important than timing the market. But late in the cycle, how capital is allocated has a greater impact. A flexible, globally diversified, multi-asset approach with the ability to adjust exposures as markets evolve should offer the best path to navigating a market cycle that is becoming less forgiving and more complex.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.