Calgary hasn’t felt like summer with all the rain, but the sun has been shining on equities and risk sentiment. Global equity markets continue to climb the proverbial “wall of worry,” well above pre-liberation day levels and are near all-time highs. On the plus side, ultra-aggressive trade policy has been walked back to more manageable levels, the “One Big Beautiful Bill” should boost 2026 real GDP by just under 1%, core inflation continues to moderate, and the majority of corporations reporting Q2 earnings have beaten and raised guidance. On the minus side, even with a lighter tariff framework, Yale’s Budget Lab estimates tariffs will shave ~0.5pp from real GDP in each of 2025 and 2026.

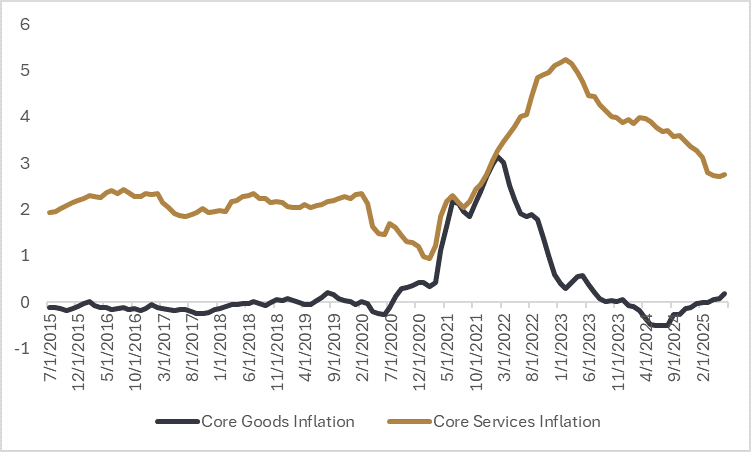

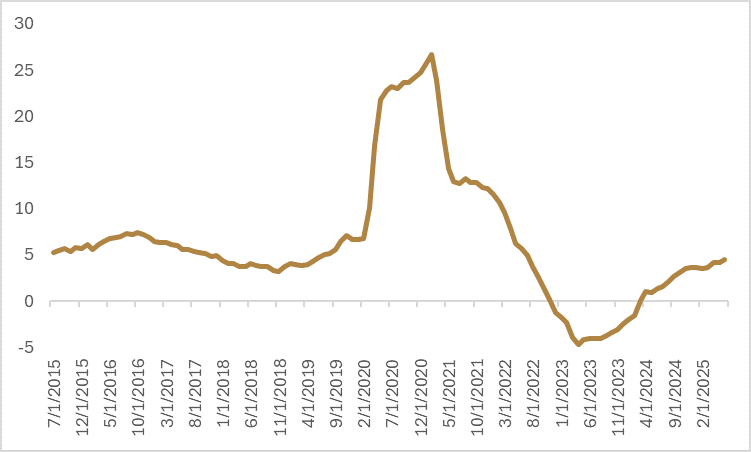

Trade policy uncertainty from earlier in the year is starting to filter into the underlying economic data, with revisions to non-farm payroll gains in the U.S. illustrating hiring stalled for the months of May and June. As noted above, core inflation is indeed moderating, but this is mostly a result of downward pressure on prices for services and we’re starting to see prices for goods trend upward as the effects of tariffs are passed along to U.S. consumers.

There has also been a slow erosion of trust in U.S. institutions, with the administration’s continued pressure on the Federal Reserve to lower interest rates, the firing of the Bureau of Labour Statistics Commissioner due to the aforementioned jobs data revisions, and the appointment of Stephen Miran from the Council of Economic Advisors to fill the recent vacancy as a Federal Reserve governor.

Despite the clouds starting to encroach on the proverbial bright skies of global GDP growth into the back half of the year, the macroeconomic backdrop still appears to be mildly conducive to risk assets. August and September tend to be a challenging two-month stretch for risk assets from a seasonality perspective, with the S&P 500 averaging a return of -0.6% in August and just slightly less than -1% in September over the last 35 years. However, financial conditions are the loosest they’ve been since early 2021 and the money supply is growing again, which is a positive for credit health and the underlying economic backdrop. Add in that most of the potential headwinds to growth for the remainder of 2025 are cornerstones of the U.S. administration’s economic platform (tariffs and immigration), so, if we see a material slowdown in growth, these policies can be tweaked to support asset prices.

This is different from earlier in the year when the administration was advocating for a growth detox from DODGE initiatives. The narrative from the administration has now switched to growing out of the debt, which should signal a more pro-growth mindset where fiscal policy can be tweaked to mitigate downside risks to growth and consumption. Political incentives likely reinforce that tilt: approval ratings are soft, and heading into the midterms, the White House is unlikely to risk losing control of Congress if approval ratings drop any further due to a weakening economy.

The imposition of tariffs has given the administration a quick fiscal dial that can be used should growth falter. Analysis from Goldman Sachs suggests most of the current consumption tax burden is borne domestically—partly via consumer prices, partly via margin compression. That “tax” boosts revenue and narrows the deficit, but it also creates a fast, executive-controlled fiscal lever: if growth softens, the administration can send tariff rebate cheques or selectively cut tariffs through new trade deals. Either move reduces revenue relative to the newly established baseline, loosening fiscal policy more quickly than a full budget process or waiting on the Fed to lower interest rates.

Tariff fluidity reinforces the perceived “Trump put” for equities and risk assets, which was illustrated last week when the 100% semiconductor tariffs came with the caveat that firms committing to U.S. production would be exempt; another example of a pro-business carve-out from the otherwise protectionist policies. While equity investors may be feeling sanguine about the always evolving tariff carousel, there have been some extreme price moves in certain commodity markets as traders try to get a handle on how tariffs will affect supply and demand for raw materials.

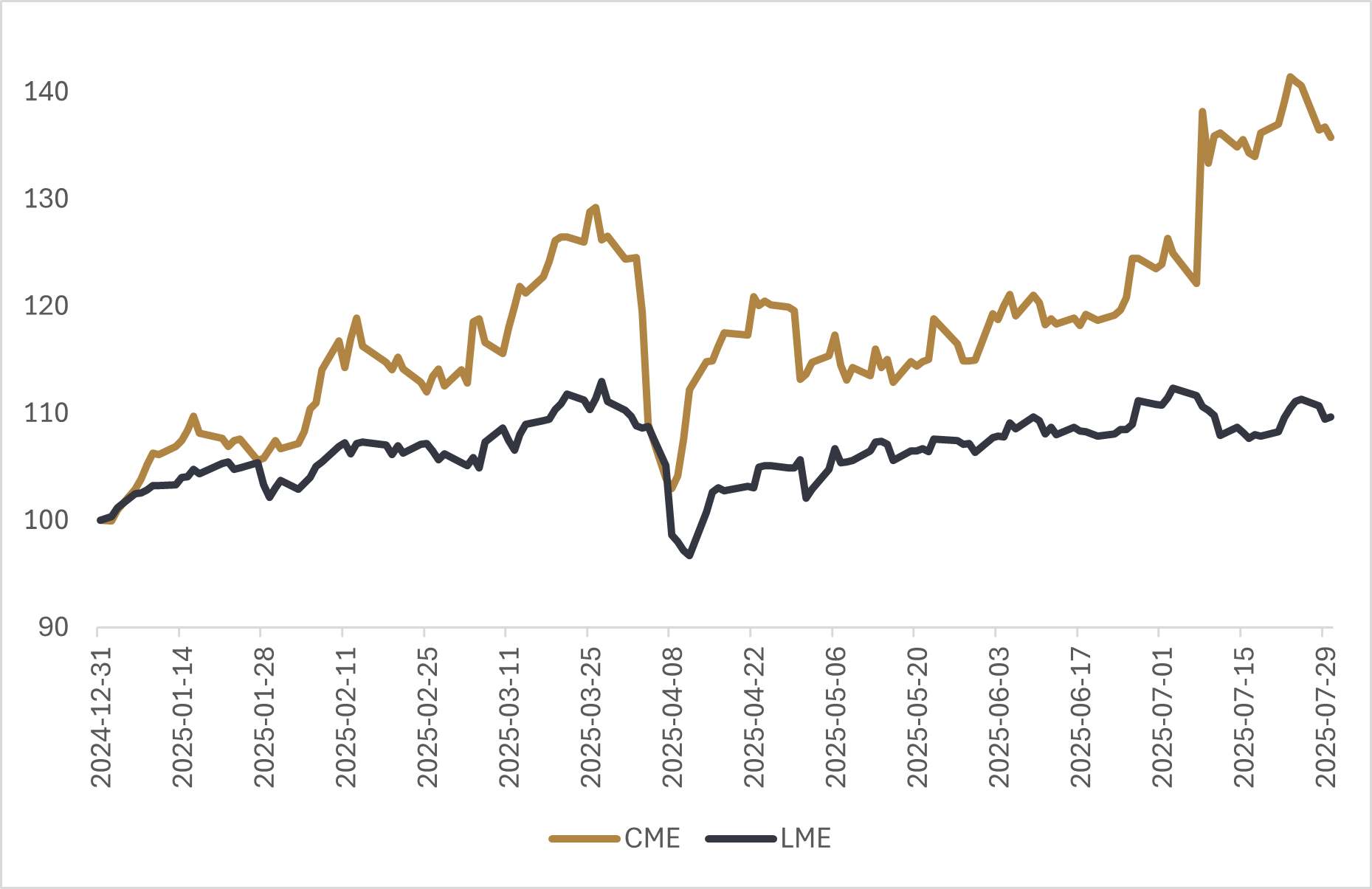

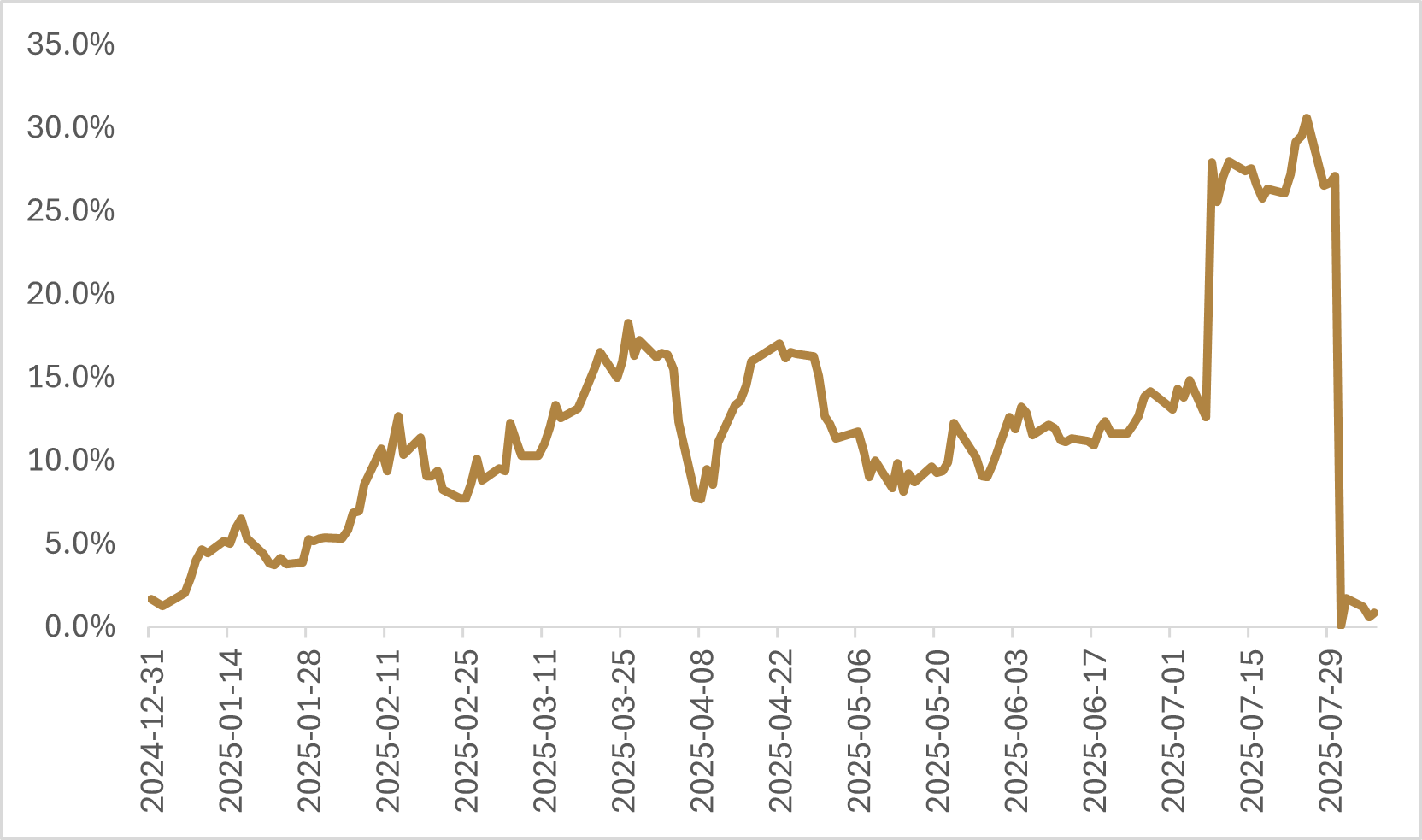

We have discussed in previous notes about the uniqueness of the copper futures market and how different geographical locations for delivery of the metal have resulted in different prices. Copper traded on the CME exchange (U.S.) is duty-paid copper delivered into the U.S., while copper traded on the LME exchange (London) is international, non-duty paid copper. Earlier in the year the price spread between the CME and LME started to widen when traders began to expect the potential for copper to experience similar tariffs like steel and aluminum, which then blew out when the administration proposed a 50% tariff on all copper imports.

From January 1 to July 30, CME front-month copper rose ~39% vs. ~8% on the LME (a peak ~31% spread). On the afternoon of July 30, the White House limited the 50% tariff to processed products, exempting raw/refined copper (the benchmark futures contracts track) and caused CME futures prices to fall >20% in a day and the CME–LME spread collapsed back to ~zero. While the exemption was economically sensible—the U.S. imports ~45% of its copper, and taxing raw inputs would have added roughly $4.5 billion in costs at current prices—the announcement caused a massive whiplash for copper traders.

A macroeconomic environment highlighted by geopolitical fragmentation and protectionism continues to reinforce the key role that commodities will play in investment portfolios. However, evolving supply chains make price formation more local—and delivery specifications matter. Our philosophy at Viewpoint pairs a broad opportunity set with geographic diversification where possible: transport frictions and government policy are making commodities less “commoditized,” so holding multiple delivery points reduces single location specification risk, a point illustrated by the recent copper market volatility.

As the U.S.–London basis widened in 2025, the Viewpoint commodities strategy shifted half its copper exposure from CME to LME in mid-July, aiming to reduce tariff-headline risk and the steeper contango on the CME as metal rushed into U.S. warehouses—raising carry costs vs. the LME. The move to split exposure between the two trading hubs diversified location risk, lowered roll costs, and was a positive contributor to relative performance when raw copper was later exempted from tariffs and CME prices tanked. The key takeaway is that to harvest commodity beta efficiently, investors should be building risk-balanced exposure across delivery hubs—something concentrated, production-weighted index ETFs often miss.

Copper isn’t the only case where a wider U.S.–London basis is emerging, with the cocoa market also seeing a stark price divergence. The difference in the cocoa market is that the potential for tariffs is only a partial driver of the situation, especially because there have been talks the U.S. will provide exemptions for non-U.S.-grown crops (coffee, cocoa). A bigger force is Europe’s new deforestation rules (EUDR). With “pod-to-port” traceability required, older, lower-quality beans—especially from Cameroon, where traceability is weak—are piling up in London warehouses and putting downward pressure on prices. While U.S. tariffs on non-U.S.-grown agricultural crops remain unlikely, compliance frictions around the traceability of cocoa could keep the spread elevated. Our base case is a narrowing of the spread over the medium term as discounted stock clears and as pragmatic rule tweaks improve deliverability into Europe given the struggle importers are having with the new regulations.

Fiscal levers and easy financial conditions can still cushion a global slowdown, and commodities remain integral to robust, inflation-aware portfolios. Yet geopolitical fragmentation is making commodity price formation more local—and more uneven—so portfolio construction matters. Utilizing a rules-based framework that focuses on building breadth across exchanges and delivery points can help diversify basis risk, curve mechanics, and policy shocks, giving investors the best shot at harvesting commodity beta in the most efficient manner.

While large index-tracking commodity ETFs may appear to be a cheap option for commodity exposure, these products often rely on single-venue contracts that embed specification risk, which can overwhelm any headline fee savings. In a multipolar, protectionist world, implementation and execution are where returns are won or lost. Design for resilience first; the upside tends to take care of itself.

Happy investing!

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.