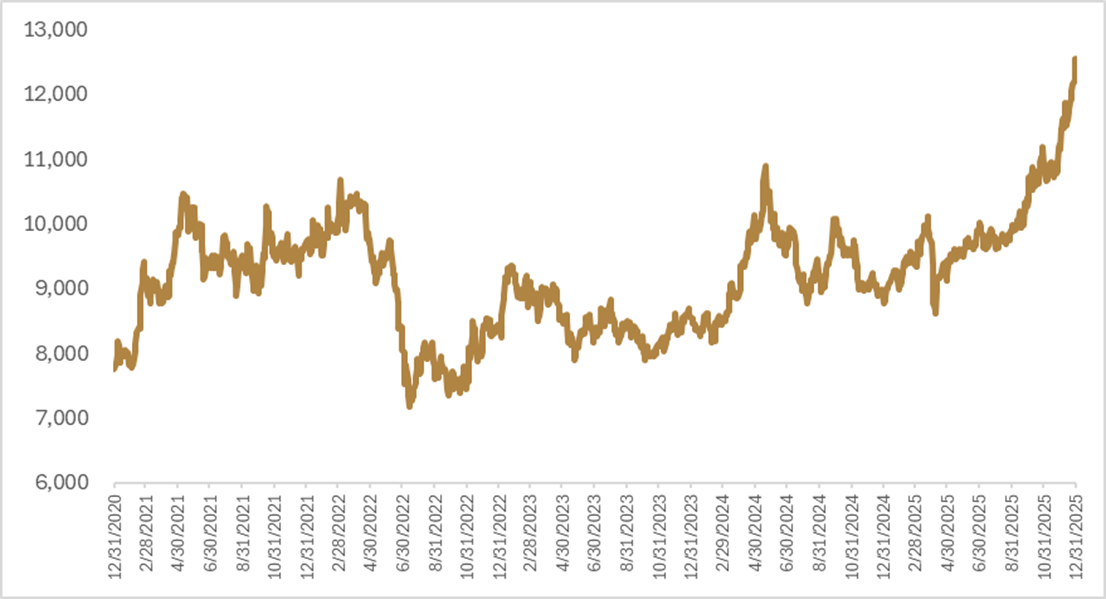

For commodity markets, 2025 will go down as the year of the metals. Precious and industrial metals both delivered standout returns. Silver, platinum, and palladium grabbed headlines late in the year as speculative positioning drove sharp volatility. Copper, meanwhile, quietly put up its best annual performance since 2009, rising 35% on the year.

The second-half surge reflected a mix of factors: stabilizing Chinese growth expectations as trade tensions thawed, a weaker U.S. dollar, and a market increasingly willing to pay for reliability in a supply chain that keeps breaking.

On the supply side, 2025 was a reminder that copper is a fragile market. Geographical concentration of production means that when large mines stumble, the supply–demand balance can shift quickly. The year delivered a string of high-profile disruptions that will likely spill into 2026. Chile’s nationwide blackout in late February temporarily knocked major mines offline, underscoring infrastructure fragility in the world’s top copper-producing country. In the DRC, Ivanhoe’s Kamoa-Kakula complex suspended underground mining after repeated seismic events contributed to flooding and water-management challenges. Chile then suffered another major shock when Codelco’s El Teniente halted production following a fatal collapse in the summer, with the company estimating a meaningful hit to 2025 output. In September, Freeport’s Grasberg mine in Indonesia was hit by a major mud flow that shut operations, triggered a force majeure declaration, and raised the risk that recovery could take years, not months. Grasberg accounts for roughly 3–4% of global copper supply, and early estimates suggest production may not return to pre-incident levels until 2027.

Supply was the headline story for copper in 2025; demand, by contrast, has been less compelling. The longer-term narrative of grid upgrades, electrification, and power infrastructure remains intact, but near-term fundamentals have been softer. Goldman Sachs is estimating a larger-than-expected surplus into year-end 2025, reflecting weaker Chinese demand in Q4 as the boost from earlier stimulus front-loading fades. Goldman’s longer-run fundamental forecast has the copper market in a small surplus through 2028 before shifting into deficit in 2029. The International Energy Agency’s pathway analysis points to a broadly similar glidepath, while the International Copper Study Group has emphasized greater 2026 supply risk stemming from this year’s disruptions and is forecasting a small, refined deficit in 2026. With China accounting for roughly 60% of refined copper demand, Chinese demand growth remains the primary short-term driver of price action absent another major supply outage.

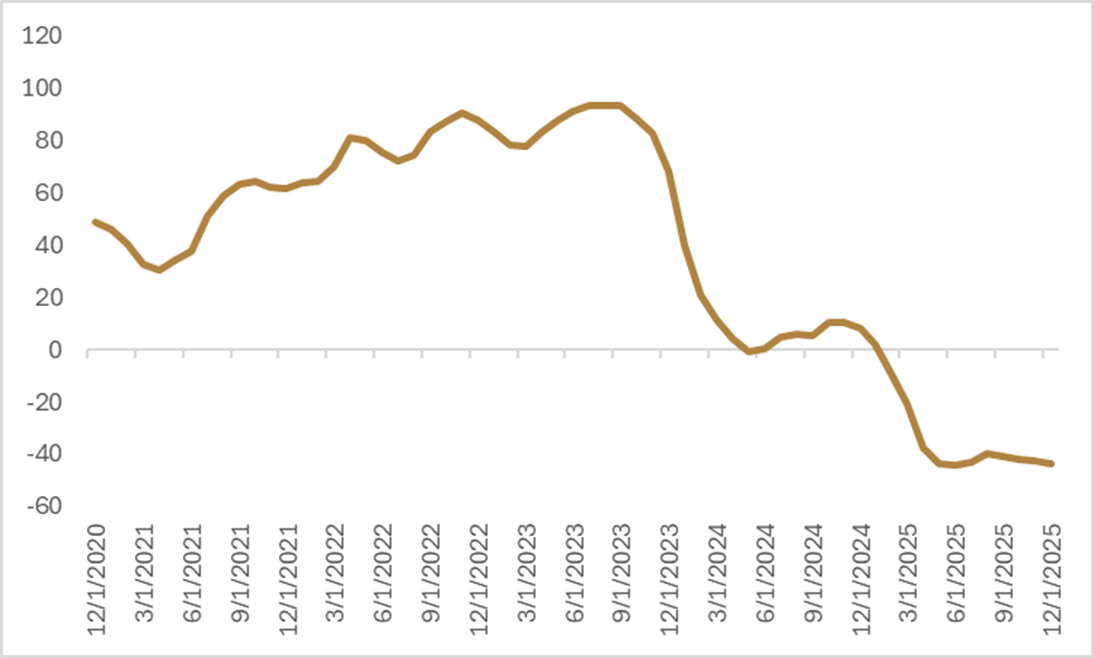

The 2025 disruption cycle has also tightened the upstream chain. Limited concentrate availability has pushed China’s treatment charges for processing copper concentrate into negative territory. Spot terms have become so stressed that smelters are effectively paying up to secure concentrate, squeezing margins. Some of the pressure on treatment charges also reflects smelter overcapacity, which increases the likelihood of a downshift in refining throughput to restore more sustainable economics. Importantly, treatment charges alone are not sufficient evidence that the refined cathode market is tight. For confirmation, we also monitor the Yangshan copper cathode premium: if it begins to rise, it signals that China’s import demand is pulling refined copper away from the LME system—an important indicator of near-term tightness. At present, the Yangshan premium sits slightly below its five-year average, which argues against an immediate refined-market squeeze.

Our view is that copper’s strong 2025 performance has been driven more by a supply-risk premium than by a fundamental upshift in demand growth. Copper is behaving like a market that is paying for reliability—something that has been in short supply. Speculative interest is also beginning to look stretched, approaching the positioning seen in early 2024 when prices pushed toward $11,000 per tonne before a sharp pullback. We remain bullish on copper and industrial metals as a long-term theme, but at current levels we find it difficult to justify adding fresh long exposure with LME copper around $12,500 per tonne. From a risk-reward perspective, we would be more interested in adding on pullbacks—closer to the $10,000 area—than chasing momentum at today’s prices. That said, we continue to see value in maintaining existing exposure. The disruption cycle of 2025 has reinforced that copper supply is becoming structurally less elastic: as mines age, a growing share of capital spending is directed toward sustaining output rather than expanding capacity, leaving the market more vulnerable to shocks.

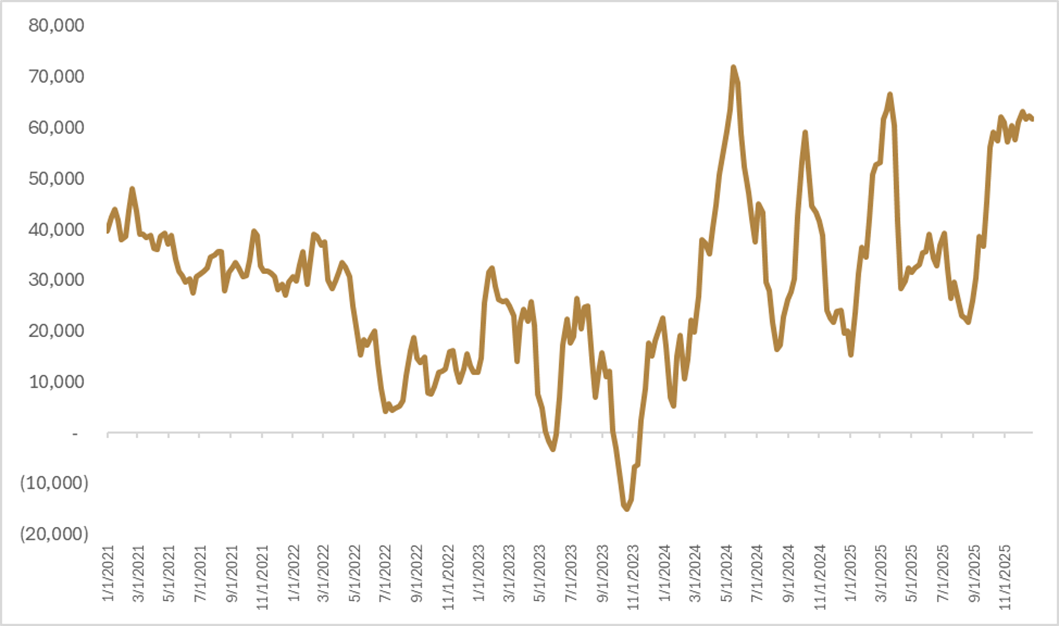

In 2025, copper also reminded investors that location is a position. Where you own the metal can matter almost as much as why you own it, particularly as deglobalization and geopolitical multipolarity distort trade flows. U.S. tariff headlines injected additional volatility into the copper market as traders attempted to anticipate whether refined cathode imports would be targeted. The initial reaction was a surge in copper imports into the U.S., as market participants sought to get ahead of potential policy changes. Ultimately, the 50% tariff was applied to semi-finished copper and copper-intensive derivative products, while tariffs on refined copper were deferred into a later, phased-in proposal, with current recommendations pointing to a 15% rate beginning in 2027.

With tariffs on refined copper still a live risk, we would expect continued inventory building in the U.S., which could tighten availability elsewhere. That geographic imbalance is already evident in futures curves. Abundant U.S. warehouse supply has contributed to contango on COMEX—implying negative roll yield—while the LME curve has remained in backwardation, consistent with tighter ex-U.S. availability. This divergence underscores why risk-balanced commodity exposure across delivery hubs is an important component of harvesting commodity beta efficiently, and an area where concentrated, production-weighted commodity index ETFs often lack flexibility.

We remain bullish on copper as a core industrial-metals theme, and for investors seeking differentiated exposure beyond the commodity itself, Chilean equities and the Chilean peso (CLP) offer a compelling copper-adjacent complement. President-elect José Antonio Kast represents a shift from a progressive, centre-left reform coalition toward a more market-friendly agenda aimed at improving growth and affordability. While a fragmented Congress will likely temper policy outcomes, even a modest improvement in the investment climate—particularly around permitting, taxation clarity, and project execution—could help revive resource development after several years of constrained capital formation.

Chilean equities are already in the midst of a strong rally. The iShares MSCI Chile ETF (ECH) is up roughly 65% in USD terms for 2025, with a significant portion of the move concentrated in Q4 as copper strengthened and election probabilities shifted toward the new government. Despite the strong year, Chile has still lagged global equities over the past five years, leaving valuations relatively reasonable. Chile trades at roughly 14–15x forward earnings versus approximately 22x for global equities. A supportive geopolitical backdrop could further help narrow the risk premium embedded in Chilean assets, particularly if the U.S. follows through on a renewed Western Hemisphere priority (as outlined in the recent U.S. National Security Strategy) that emphasizes resilient supply chains and strategic resources among aligned partners. The so-called Trump Corollary to the Monroe Doctrine suggests a tilt toward developing strategic supply chains closer to the U.S., which could support investment flows into resource-rich, politically stable markets such as Chile. Finally, the Chilean peso strengthened roughly 10% against the U.S. dollar in 2025, broadly in line with the dollar’s overall decline. Should the U.S. dollar continue to grind lower in 2026 and Chile’s policy mix improve, CLP could provide an additional tailwind to equity returns in the region.

Copper capped off a standout year for industrial metals, but the story behind the move was less about a sudden surge in demand and more about a rising supply-risk premium driven by mine disruptions and policy-driven trade dislocations. We remain bullish on copper as a longer-term theme given persistent structural supply challenges, but after a powerful rally, patience is warranted. We would prefer to build exposure on pullbacks rather than chase momentum at elevated price levels. For existing allocations, we continue to see value in maintaining exposure while being thoughtful about where that exposure is held, as divergence between U.S. and ex-U.S. stockpiles continues to influence curve structure. Finally, for investors seeking nuance beyond the metal itself, Chile—through both equities and the peso—offers a compelling extension of the copper thesis, supported by attractive relative valuations and the potential for a more supportive investment backdrop in 2026.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.