The U.S. economy is approaching a critical juncture, as a softening labor market coincides with growing pressure on the Federal Reserve to ease policy. Markets now expect a September rate cut, with more likely to follow by year-end. Political tensions have intensified, as the administration presses Chair Jerome Powell to resign and seeks to remove Governor Lisa Cook, testing the Fed’s independence. Meanwhile, long-term yields are rising in the U.S. and abroad as governments show little capacity—or political mandate—to rein in spending, leaving investors to contend with a policy environment tilted toward running the economy hot.

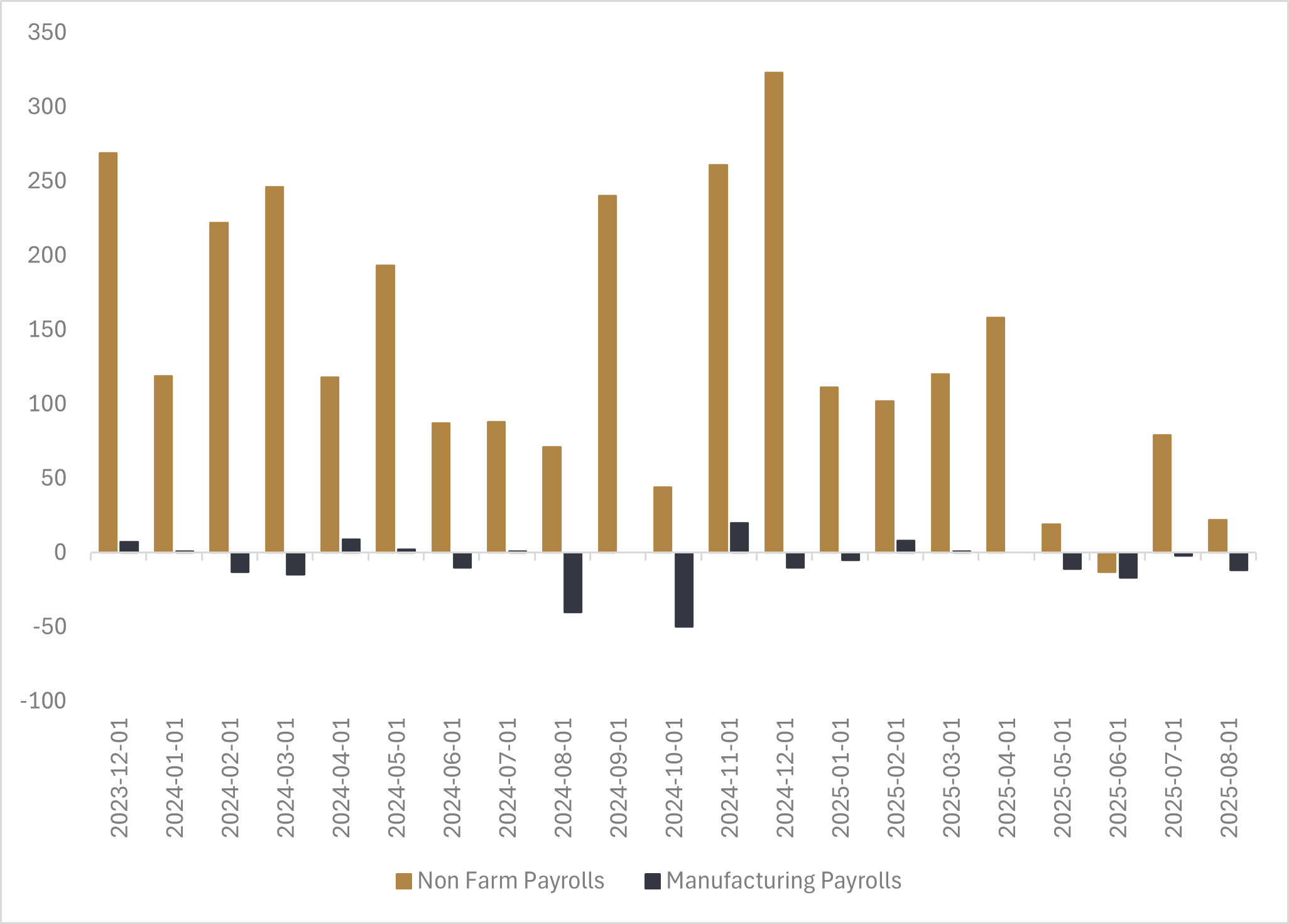

Friday’s employment report underscored the slowdown in U.S. hiring, with just 22k jobs added in August versus a 75k forecast and unemployment edging up to 4.3%. Revisions now show June payrolls turned negative, leaving the three-month average at only 29k. Manufacturing employment has fallen for four straight months—an unwelcome trend for an administration that has touted tariffs as a tool to revive the sector. North of the border, Canada shed 65k jobs in August against expectations for a modest gain, pushing unemployment to 7.1%. While most of the losses were part-time, the report still highlighted a weaker labour backdrop than anticipated.

For investors, the key question is whether the labor market weakness is temporary, reflecting tariff-related uncertainty, or a sign of deeper cracks that leave the Fed behind the curve. My view leans toward the former, but the latest data gives the Fed a greenlight to cut rates at the September meeting. Markets have fully priced in a 25bps cut, with some speculation of 50bps, though I expect the Fed will want to wait for clearer evidence of sustained labour market weakness before committing to additional easing.

After Friday’s employment report, futures now imply three cuts by year-end. Further economic data will be released this week with the inflation report for August, which will be the last major data point before the Fed’s September meeting. The Bank of Canada faces a similar dilemma. What looked like the end of its easing cycle in June has shifted, with markets now pricing at least one—and possibly two—additional cuts following weaker jobs data.

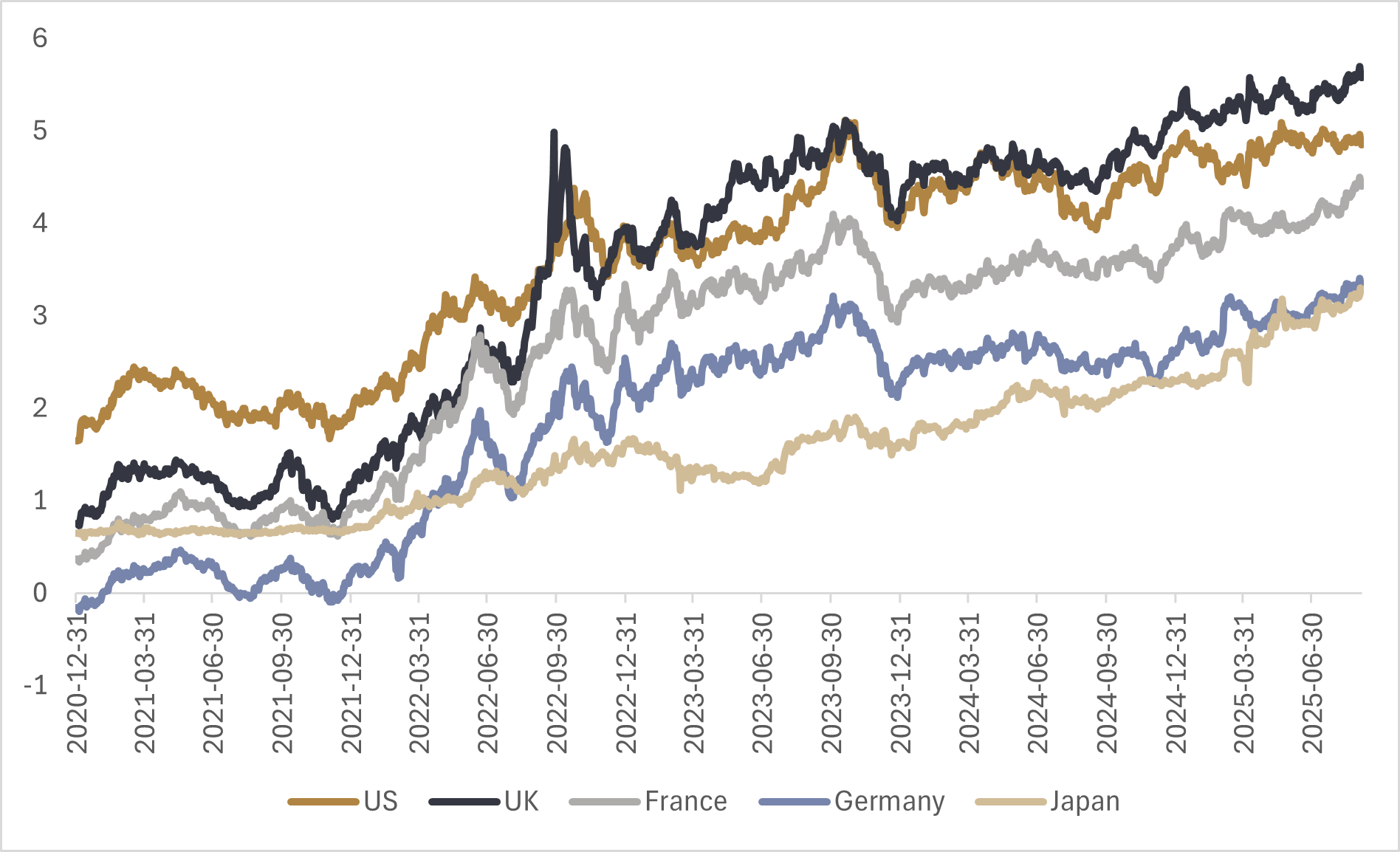

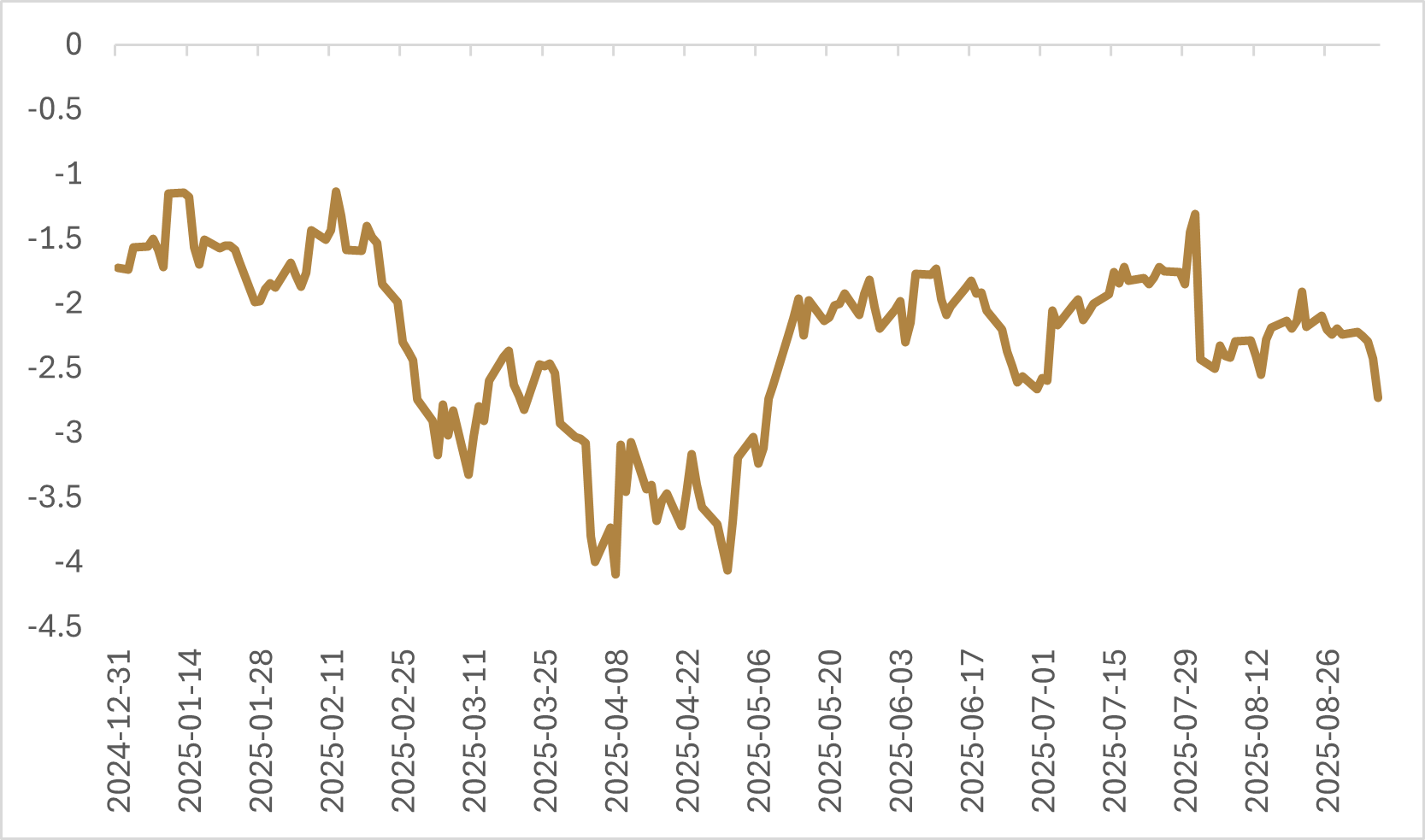

Even as the Fed restarts its cutting cycle, longer-term yields may not move lower in tandem. Should a recession emerge, long bonds are likely to perform well, but the current environment does not yet justify the level of easing the administration has been calling for—Scott Bessent, for example, argued last month that rates should be 150–175bps lower. Financial conditions are the most accommodative since early 2022, M2 money supply growth has returned to pre-COVID levels, goods inflation is edging higher, and the Taylor Rule points to an overnight rate that should be closer to 6%.

Like the Sahm Rule on the fiscal side, the Taylor Rule was designed as a transparent and prescriptive framework for monetary policy, offering a benchmark against which to judge policy. While there are valid reasons rates could sit below this rule-based prescription—particularly if tariff-related inflation proves transitory and labor market weakness accelerates—the backdrop today is far from the late 1980s, when policy persistently ran tighter than such guidelines would suggest.

In our last note, we highlighted the administration’s political incentives to run the economy hot into next year’s midterms. That view has only been reinforced. New Fed governor Stephen Miran testified to Congress that he would not resign from the Council of Economic Advisors to take up his Fed role, opting instead for a temporary unpaid leave—an unprecedented blurring of lines between political and monetary institutions. This follows the administration’s attempt to remove Governor Lisa Cook “for cause,” another first in Fed history. While the legal case appears thin, the Supreme Court has consistently favored executive authority over congressional limits, raising the risk that the administration could gain majority control of the Fed Board.

At present, three governors are Trump appointees; Cook’s removal or Powell’s resignation would pave the way for a majority on the seven-member board. This matters because the Board holds significant influence over the 12 regional Fed presidents, four of whom vote alongside the permanent New York Fed president on the FOMC. A majority could therefore reshape not just overnight rates but also the Fed’s balance sheet strategy. With quantitative tightening reducing the Fed’s balance sheet, a politically aligned Board could reopen the door to targeted QE, especially if long-term rates remain stubbornly high. The institutional risk is not theoretical: research by Carola Binder shows that political attacks on central bank independence can raise inflation expectations even absent policy changes. The parallel to Arthur Burns in the 1970s—when the Fed yielded to political pressure with costly inflationary consequences—is becoming increasingly salient.

The administration’s efforts to exert greater influence over the Fed, from contested appointments to unprecedented removal attempts, underscore the erosion of central bank independence. History suggests that such pressure rarely ends well: when political priorities override monetary discipline, inflation expectations can become unanchored, as Carola Binder’s research and the cautionary Arthur Burns era both remind us. With fiscal levers still engaged and monetary policy poised to ease, the backdrop is set to remain stimulative into next year’s elections.

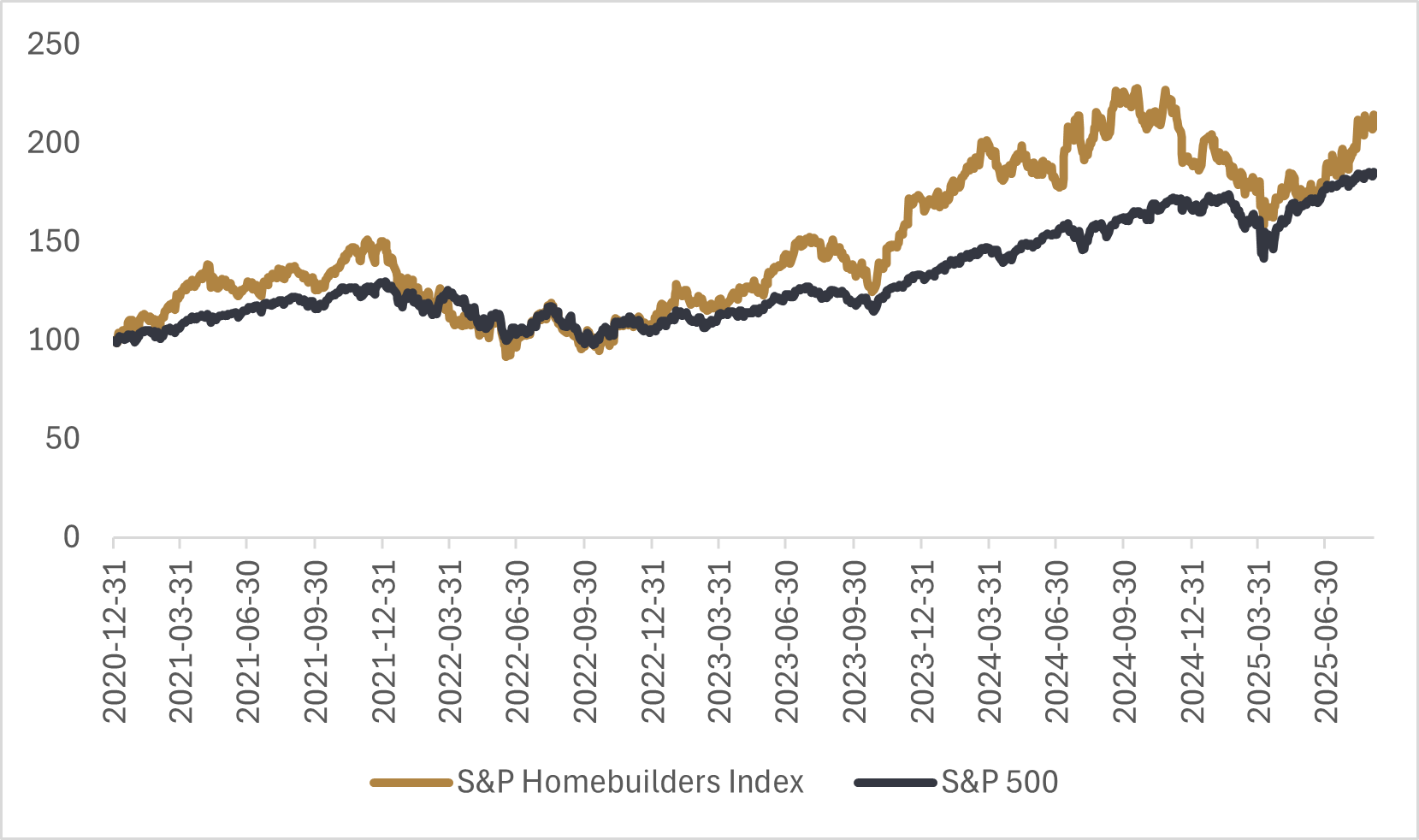

In our view, this mix points to higher long-term yields, a softer U.S. dollar, and persistent inflation risks. Equities with defensive and global tilts can help buffer volatility, but the clearest opportunity lies in commodities. Precious metals remain well positioned as inflation hedges, while more cyclical commodities like lumber could benefit if the administration declares a national housing emergency and pushes to lower mortgage rates.

With U.S. housing and construction likely to be political priorities, homebuilder equities are already stirring, and lumber may find support after a steep slump due to near-term oversupply. In an environment where both fiscal and monetary incentives lean toward running the economy hot, commodities stand out as the most reliable hedge against policy-driven inflation. We continue to recommend an overweight allocation.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.