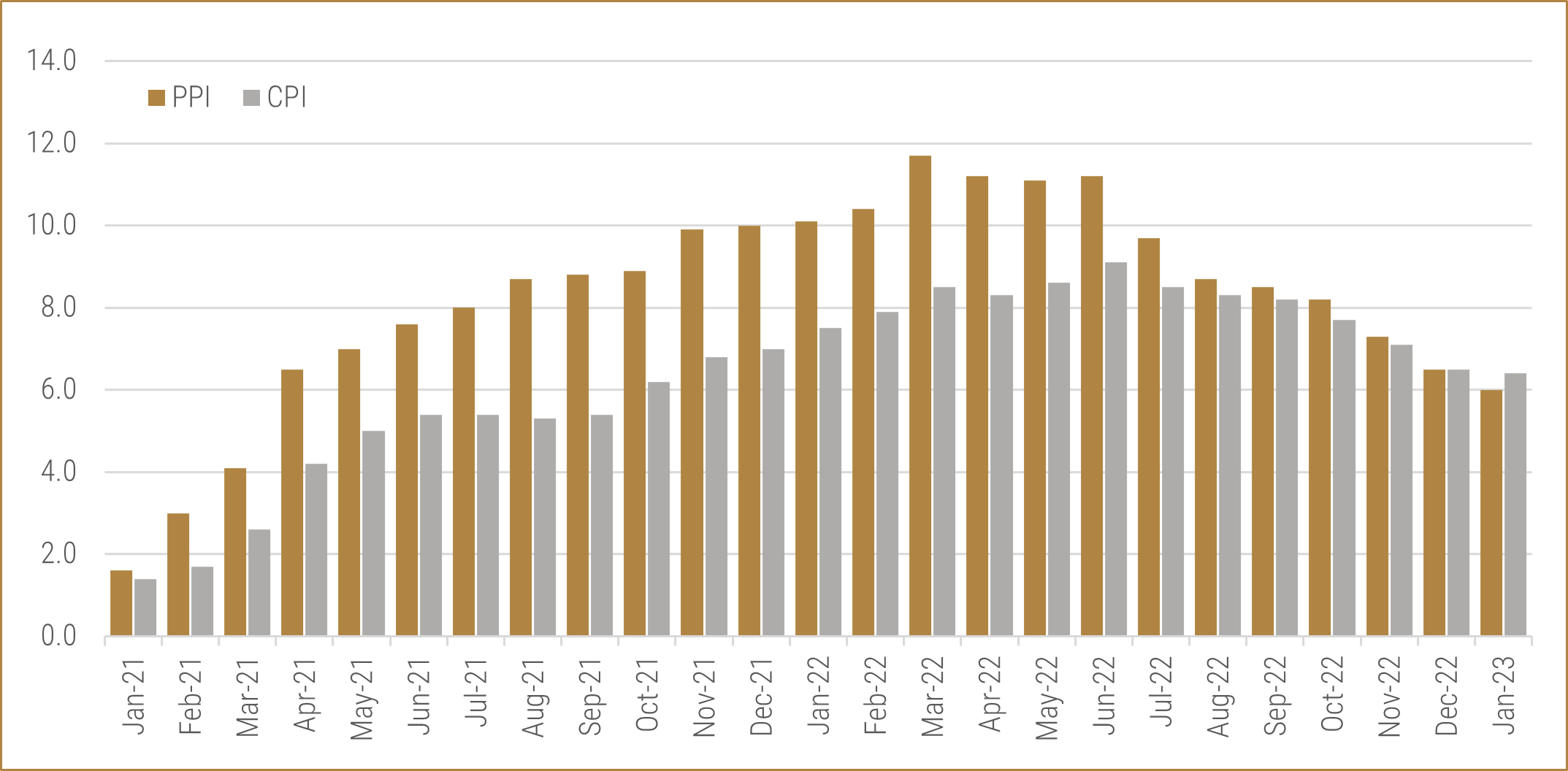

Since the onset of the Great Financial Crisis (GFC) in 2008 – and maybe back to the Dot Com bust in 2000 – market participants have become accustomed to easy financial policy and a supportive Federal Reserve (Fed). As discussed in Inflation – Why So Much Focus?, “[s]uccessive Federal Reserve Chairs have now followed Mr. Greenspan, and each has continued to be accommodative and innovative in the ways that will support economic growth and protect financial markets.”Given the bias towards accommodation that has been seen for decades, it is understandable that investors seem to over-value positive indicators in their risk assessment. Two indicators that have been providing positive incremental news since the summer of 2022 are the main U.S. inflation measures of Consumer Price Index (CPI) and the Producer Price Index (PPI), each of which has cooled significantly since their peaks in 2022. PPI peaked at 11.7% in March 2022 and remained steadily elevated over 11% through June 2022, and CPI peaked in June 2022 at 9.1%. Both have seen steady declines since then and were measured at 6.0% for PPI and 6.4% for CPI in January 2023.

Figure 1: U.S. Consumer Price Index (CPI) & Producer Price Index (PPI)

January 2021 to January 2023

Source: Bureau of Labor Statistics: https://www.bls.gov/cpi/ & https://www.bls.gov/ppi/

Investors have interpreted these improvements as a taming of inflation that can allow the Fed to begin to consider pausing – or at least slowing – its interest rate increases. More bullish investors have even begun to envision a soft landing and the potential of a Fed “pivot” that would see the start of cuts to interest rates. These bullish sentiments have led to a strong rally in equity markets since the market lows in September 2022.

This brings us to the Fed’s “reaction function,” which is a well-studied area of economic literature. Without going into the gory details, a central bank reaction function provides a predicted outcome to a monetary policy tool that a central bank uses to respond to prevailing economic conditions. One can think of the reaction function as a description of how monetary policy settings are adjusted in response to evolving conditions and expectations. The market attempts to predict the Fed actions in order to predict what might happen to financial markets.

Predicting Fed behaviour is always a challenge, but it has become more challenging as we are sailing through some challenging terrain. When this is the case, it is best to remember the adage “Don’t fight the Fed,” as discussed last February in FOMC Gymnastics and a Potential Policy Misstep. As we attempt to avoid fighting the Fed, it is best to consider the situation of the Federal Reserve chair Jerome Powell and listen closely to his comments.

It was clear from the December Fed minutes that Powell had shifted his focus from inflation to employment. This was a decidedly hawkish shift as inflation was showing signs of improvement, while employment showed continued strength and is considered a lagging indicator. As such, the increased focus by Powell and the Fed on employment means that the Fed’s reaction function may now be linked to a lagging indicator – meaning the Fed seems comfortable continuing to maintain a tight monetary policy until they see a response in employment.

Focusing a reaction function on a lagging indicator is decidedly bearish for markets. It means that the Fed is comfortable with the risk that it could maintain a tight monetary policy for too long, exacerbating the potential for another policy error and higher levels of financial market volatility. With inflation firmly above the Fed’s 2% target, a strong employment picture, and a buoyant equity market, the Fed has ample leeway to maintain a tight policy stance. As always, the crystal ball continues to be quite cloudy, so investors should continue to re-evaluate their portfolios to ensure that they have diversified exposures that balance various macroeconomic risk factors.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.